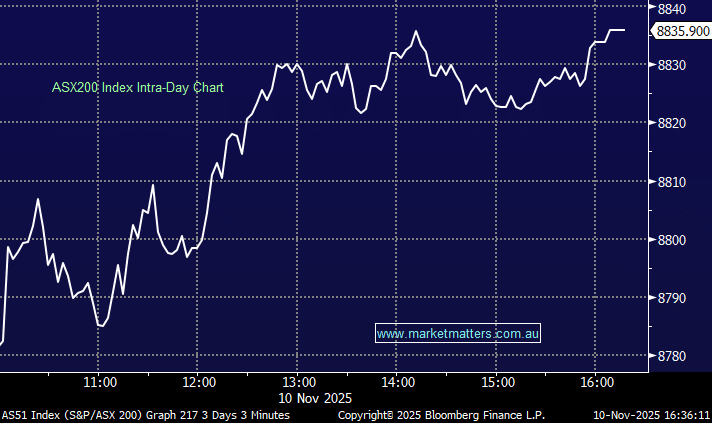

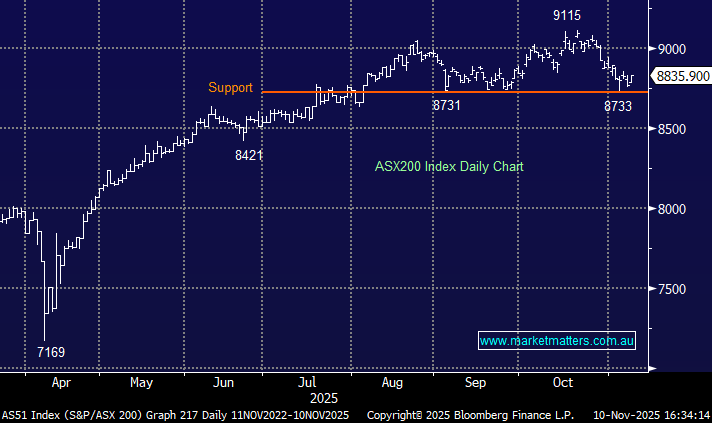

The ASX200 rallied +0.8% yesterday on reasonably broad based buying that saw over 60% of the main index rally while importantly there was an absence of any meaningful aggressive selling across any of the 11 sectors. Its early days but stocks are positive for the month following the carnage experienced by equities through June, the market feels well supported at the moment which coincides with the seasonal strength that usually unfolds through July before things historically go quiet into early October. The stock / sector rotation under the hood of the market looks destined to continue for months as investors swing between concerns around inflation / interest rates or a looming recession, in general, value stocks benefit from the former and growth the latter.

- Today’s market is a hugely sentiment driven affair with macro factors steering at the helm, old fashioned specific stock fundamentals look set to take a back seat until reporting season.

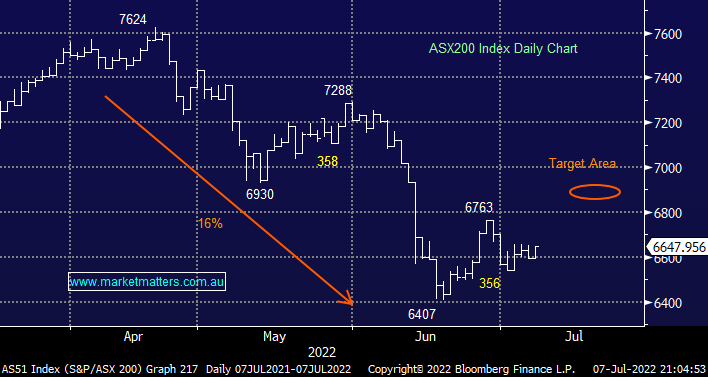

The local index continues to follow the MM road map post its panic June low, if we prove to be on-point from there are 2 more major twists in the road moving into Q3. It’s much harder to 2nd guess which sectors are going to be driving the market at any specific time as the inflation / bond yield influence continues to arm wrestle against increasing recession fears:

- Firstly we are still looking for the index to push towards the 6850-6900 region, now only ~5% away.

- Secondly we are then looking for a final washout for 2022 to fresh multi-month lows – our best guess is somewhere down towards the 6100-6200 area.

MM intends to tweak our portfolios accordingly if the above 2 chapters do unfold, importantly this is not crystal ball stuff just simply trying to add alpha / value to a portfolio within a strong downtrend since we’ve entered an aggressive interest rate tightening cycle. Obviously we may only see one, or none of the above 2 scenarios unfold but if we apply prudent risk / reward logic when we do transact MM can invest with the balance of probability on our side without taking on too much undue risk.

Overnight US stocks rallied for a 4th consecutive day as Fed hawks downplayed the risks of a recession i.e. optimism that the Fed can engineer interest rate normalisation to fight inflation without causing painful economic contraction. The S&P500 and tech heavy NASDAQ rose the most in a fortnight with the later closing +2.2% higher, the SPI futures are pointing to a strong rally by the local market with another 50-point gain early this morning for the ASX200 looking likely.