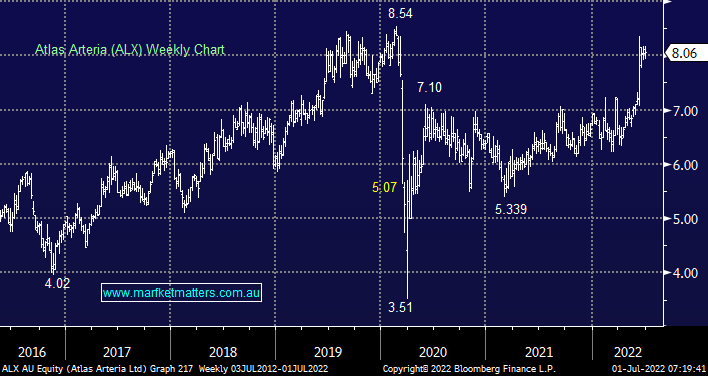

Toll road owner and operator ALX surged in June after the IFM Infrastructure Fund announced they had purchased around 15% of the business at $8.10, the obvious implication is corporate action could be on the horizon. The ~$180bn global fund already owns toll roads across Europe and the US which is very much aligned with ALX’s asset base in France, Germany & the US. History shows us that IFM are usually acquirers of total businesses hence this move looks a serious play that’s likely to evolve into a full takeover.

While it’s hard to argue that the stock is cheap at the moment – which shouldn’t surprise with a takeover looking likely – its projected yield of 5.7% over the next 12 months, an attractive long-life asset base and the next dividend due in September, it’s easy to construct a positive investment thesis on this stock.