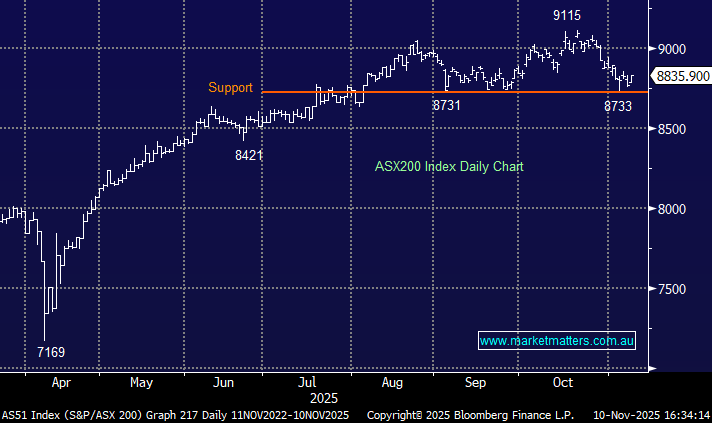

The ASX200 bode farewell to the financial year in the same bearish manner that’s dominated the last 2-months taking its decline for the tax rule-off period to -10.2%. Losses on the disappointing Thursday compounded through the day with the index closing down 2%, only 10% of the main board managed to close in positive territory but the fall wasn’t caused by tax-loss selling as many might discuss this morning, it was all about aggressive falls in global risk assets during our time zone which flowed into the ASX:

- The S&P500 futures were down ~1.4% when the local market closed as US equities looked set to deliver their worst 1st half performance in decades.

- The highly volatile Bitcoin which so often leads equities plunged over the day trading down around 6% by the time most Australians went home from work – not an encouraging forward indicator.

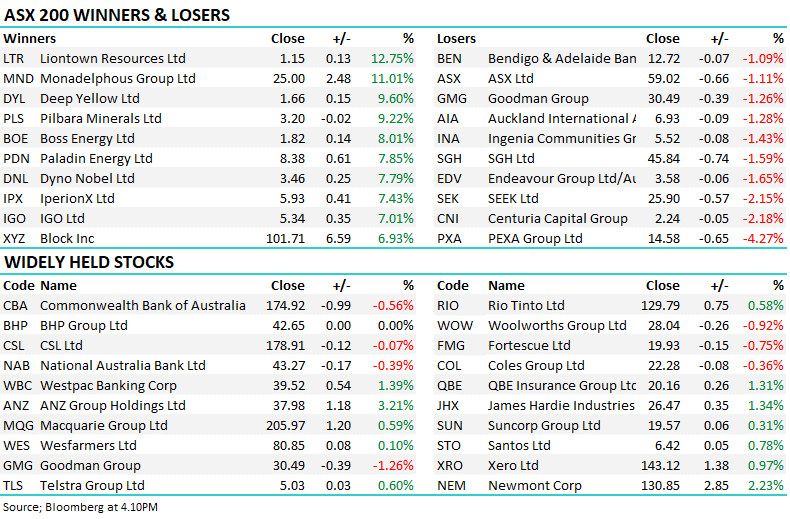

Banks made some major announcements on the interest rate front which came as no surprise although they compounded the already nervous market:

- CBA increased its home loan rate by 1.4% to around 6% – it’s amazing to think you could lock in a fixed 4-year home loan for sub 2% less than a year ago.

- On the same day CBA announced its lifting interest rates on its Netbank Saver Account by 0.25% as cash slowly becomes a more viable asset class after years of paying an almost zero return.

On Wednesday night Jerome Powell said market pricing “is pretty aligned with where we’re going”, the Fed Chair also reiterated they would do whatever it takes to get inflation down, putting these comments into context:

- A 0.75% rate hike is almost fully priced into the next FOMC meeting starting on July 27th, this would take the Fed Funds benchmark rate to 2.25-2.5%.

- Further hikes are already priced into bond markets for the final 3 meetings of 2022, taking the US benchmark above 3% by year-end.

It’s these higher interest rates accompanied by growth concerns that have been the catalyst for a rerating of stocks through 2022. We believe that earnings revisions need to play some catch-up, they tend to lag and the coming earnings season will provide some important signs for what the 2nd half of the year will look like to already anxious investors.

Overnight US stocks recovered some of their indicative early losses on the futures market to see the S&P5000 finish down -0.9%, a relatively quiet session compared to ominous indications when the ASX was trading yesterday. The SPI Futures are calling the ASX200 to bounce ~0.2% early this morning although sharp losses by oil and other commodities likely to weigh on the resources stocks.