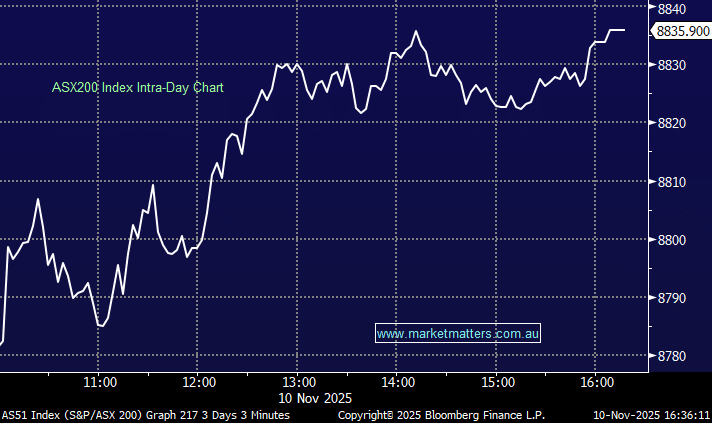

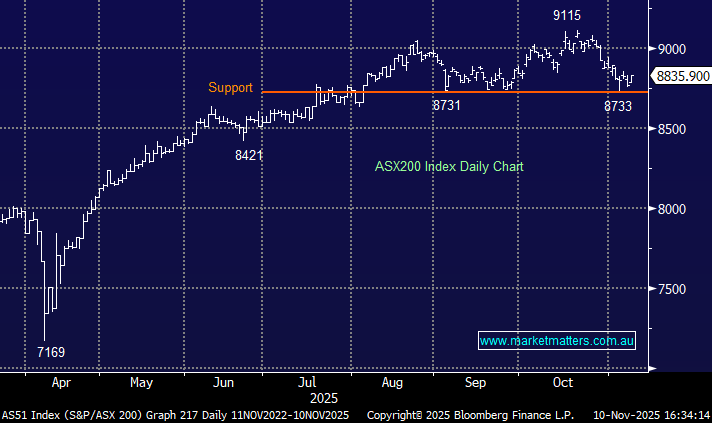

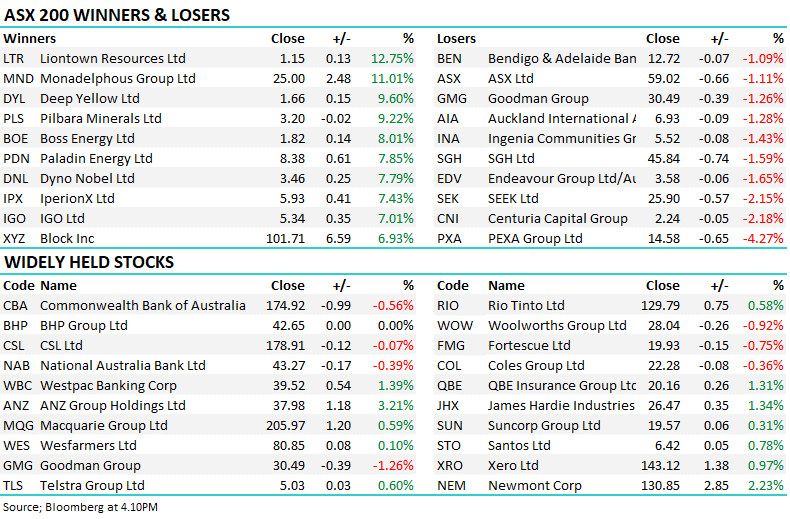

The ASX200 struggled throughout yesterday finally closing down -0.9% although it did recover a third of the morning’s losses through a relatively unconvincing afternoon bounce. Considering over 80% of the market fell it wasn’t a bad result aided by a relatively steady Banking Sector. Under the hood, it was another tough session for tech, real estate and healthcare stocks, three sectors that keep looking for a low with very little success. Overall yesterday was a quiet day bar the sharp drop on the opening, EOFY portfolio tweaks feel like they’ve already been actioned i.e. investors have become much smarter over recent years with regards to tax-loss selling now commencing much earlier.

The local market is set to post a loss of ~8% this Financial Year but it’s not all doom and gloom even though both consumer and investor sentiment is currently at almost dire levels, remember last year the ASX200 rallied +24% i.e. stocks have only given back ~30% of last year’s gains which is pretty good going considering the tsunami of bad news that’s been thrown at-risk assets over the last 6-months. We all know that the start of central banks’ hiking rates & QT has been the main headwind for stocks and in particular high-value growth stocks, I don’t actually believe it surprised many however I do feel the magnitude of the falls has caught many off-guard e.g. over the last 6-months Megaport (MP1) -71%, Xero (XRO) -46% and Altium (ALU) -39%, yet another example that we mustn’t underestimate the capabilities and volatility of the current market. One catching our eye today:

- The elastic band between the energy and tech names has stretched enormously over the last 6-months, we can see this snapping back over the coming months e.g. since January 1st Beach Petroleum (BPT) is +41% while Wisetech Global (WTC) has fallen -36%.

It’s been a notably very mixed 1H for ESG investors as they’ve sacrificed excellent gains in fossil fuel stocks while battery metals plays are mostly down for the year, it’s not a case of the underlying medium-term outlook being incorrect but underlying company valuations should never be ignored in either direction. In this case, coal, gas and oil stocks were sold off way too aggressively as investors flocked towards “green portfolios” conversely when too many investors and mandated fund managers chased often overpriced environmentally friendly names we saw stocks rise to valuations that left no room for error, a very dangerous scenario in today’s unforgiving market.

MM is really excited about the next 6-months which is likely to deliver plenty of volatility and opportunity, we just need to remain cool, calm and collected plus, of course, prepared because it might not always be a comfortable ride.

US stocks experienced a quiet but choppy session overnight which finished with most indices largely unchanged, Fed Chair Jerome Powell said the economy was in “strong shape” to withstand further rate hikes but overall it was a session void of any meaningful news. Calm would be a nice starting point for many investors with the S&P500 set to record its worst quarter since the outbreak of COVID back in early 2020. The SPI Futures are pointing to a flat open this morning with energy names likely to be under pressure following a 2% dip by crude oil.