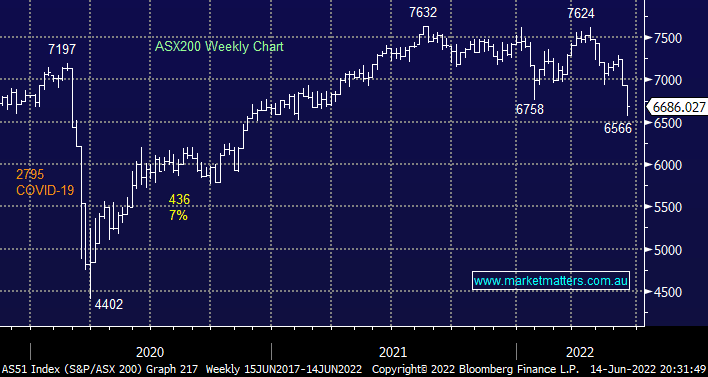

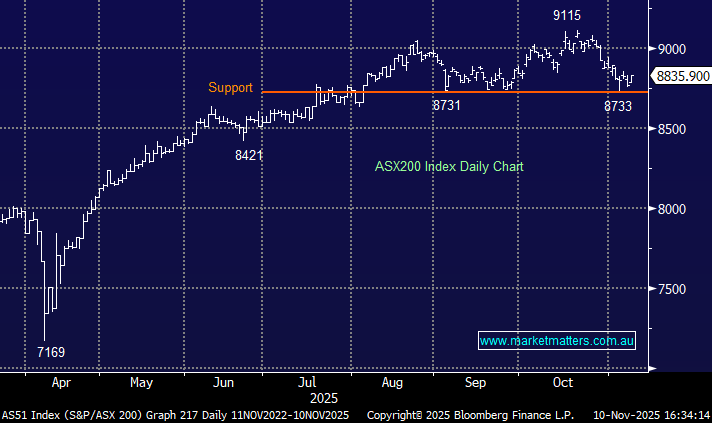

The ASX200 was hammered another -3.6% yesterday with well over 90% of the main board closing in the red, we may have bounced from support below 6600 but the market clearly remains very nervous. Recent weeks have certainly reinforced the old saying “sell in May & go away”, probably more effectively than all but the most pessimistic bears were expecting. During periods of uncertainty and volatility its important to maintain a degree of perspective even if feel like running for the hills, a move that history tells us is not a prudent course of action for long-term investors.

- Over the last 20-years the ASX200 has struggled for 2-months between late April and the end of June, certainly a road map we are on track to replicate this year after the markets -14% dip over the last 9-weeks.

- However we should also remember that MM has remained more comfortable sellers of strength through 2022 as opposed to buyers of dips.

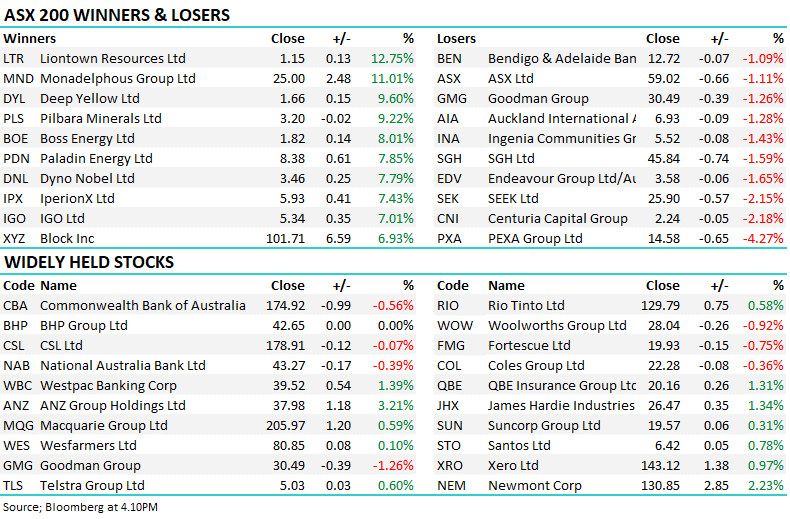

MM has highlighted the above strong seasonality characteristic on more than one occasion over the last few weeks as we contemplate tweaking our portfolios into a further weakness over the coming fortnight plus for good measure, it’s the EOFY that usually delivers some fun and games under the hood. We continue to see signs that even while bond yields and inflation are being blamed for the sell-off by risk assets some stock & sector reversion is unfolding after largely one-way traffic on the relative performance front over the last 6-months e.g. Woodside Energy (WDS) fell over -5.3% while Xero (XRO) only slipped just -1.2%.

We don’t want to sound one dimensional but in line with our conclusion from yesterday’s Macro Report, MM feels its too late to be selling the current down leg by stocks and we now believe the current sharp pullback in stocks has swung the short-term risk/reward in favour of the buyers – note we didnt say that we’re out of the woods medium to longer-term, for that will need Central Banks to successfully quell inflation without triggering a recession.

- We believe the “pop” to fresh highs by global bond yields and the $US is likely to be a “blow-off top” for 2022 i.e. an encouraging read-through for growth stocks over the coming months.

- The failure by the AUDJPY suggests stocks are close to a low but that resources may be close to a period of underperformance after their stellar post-COVID advance.

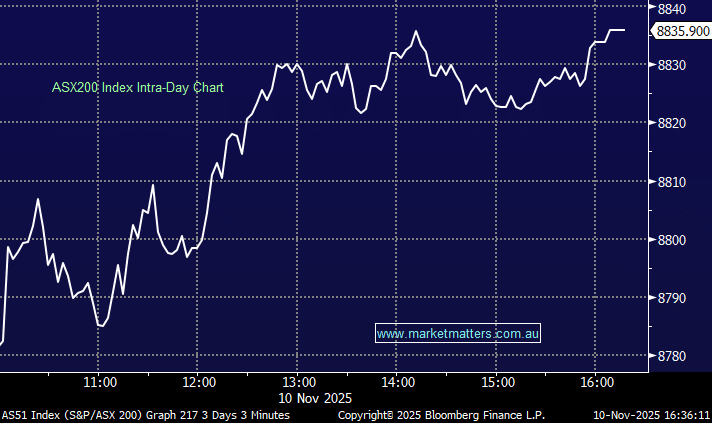

Overnight US stocks had a mixed session which saw the Dow fall -0.5% while the tech-based NASADAQ gained +0.2% i.e. growth is starting to slowly outperform value stocks. The market tried to rally early in the day but the advance simply fizzled away as bond yields continued to march higher, the SPI futures are indicating a 50-point drop by the ASX200 early this morning which almost feels like a result after yesterday.