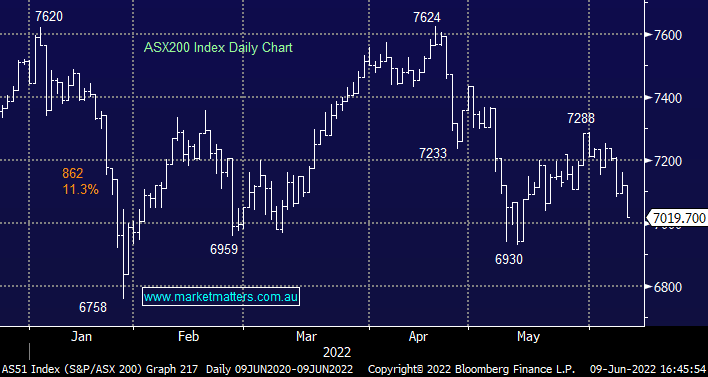

The ASX200 was smacked for the 2nd day this week as UBS’s more cautious rhetoric towards the banks continued to drive the influential sector lower e.g. Commonwealth Bank (CBA) -2.6% and Westpac (WBC) -3.7%. I can feel the questions brewing up for the weekend report “is it time to buy the banks?”, firstly lets simply revert to the seasonal statistics as the financials dance to their common June tune:

- Since 2010 the banks have fallen on average -10.7% from their May high, there are always different reasons at play but the results are consistently the same.

- Excluding the outliers pullbacks of 15-17% have been commonplace but Westpac (WBC) which has coped the brunt of the sector’s recent selling has already fallen -14.6%.

At this stage due to the high volume of institutional selling that hit the sector on Wednesday MM is reticent to fight the downside move even if the statistics say it’s time primarily due to the very real economic concerns that have triggered the drop. As we mentioned in yesterday’s report we like National Australia Bank (NAB) under $26, still another 8% below Thursday’s close, if we are correct on this one it doesn’t bode well for the index short-term.

Aside from the banks which again captured the headlines when over 80% of the market falls there aren’t many areas of optimism as investors clearly become increasing concerned around the future health of the Australian economy and in particular housing prices which have started dominating conversations with a very different standpoint to the optimism people were cheering into last Christmas – I know in our area of Sydney’s Northern Beaches they’ve already fallen 10% from late 2021.

Overnight US stocks dropped -2.3% in a late afternoon sell-off to post its worse decline in 3-weeks, the ECB triggered the decline after announcing further restrictive policies to fight inflation. It was the rhetoric as opposed to actions by the ECB which caused the move as they are now prepared to hike by 0.25% next month and importantly by the same amount or more in August if inflation dictates i.e. central banks’ willingness to hike aggressively through 2022 is clearly set to challenge economic growth.

The SPI Futures are calling the ASX200 to drop ~0.8% this morning, taking the index back under 7000 in the process.