The ASX200 was thumped -1.5% yesterday after the RBA pressed hard on the jugular of the Australian economy, its 0.5% rate hike to 0.85% was the largest in over 20-years with more rate increases promised into 2023, the futures market is now pricing in a Cash Rate of 3.1% come December.

- The RBA have been way too late to the rate rise party when we consider both the economic backdrop and how far down the path countries like the US, Canada and New Zealand have already travelled e.g. NZ has already hiked rates from 0.25% to 2%.

- The accompanying rhetoric from Philip Lowe was noticeably hawkish and reminiscent of someone justifying why they’ve missed the proverbial boat, let’s hope he can catch up without causing too much pain to everyday lives.

We believe the RBA had no choice but to go hard although our “guess” would have been 0.4%, it’s also important to remember that this financial institution based at 65 Martin Place, Sydney has a far from exemplary track record and while MM firmly believes they’ve commenced normalisation too late we feel there’s a strong likelihood they will now ultimately move too hard & fast before clarity returns to critical economic dynamics such as the Russia-Ukraine War and the prolonged supply chain disruptions.

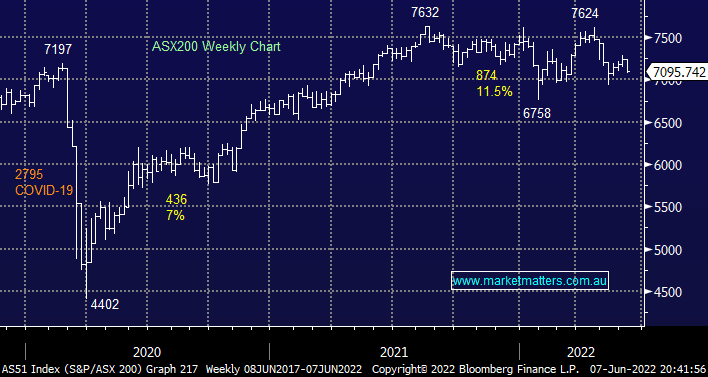

Tuesday’s heavy-handed move from the RBA sent over 85% of the ASX200 lower with very few places to hide as all 11 major sectors retreated. As we’ve touched on previously, June is seasonally a mixed month for the ASX before it regains strength in the new financial year, we cannot rule out another leg lower by the local index as higher rates weigh on the Australian market:

- The ASX200 dipped almost 700-points through April & May, a repeat performance this month would take us down towards a very sobering 6600 area.

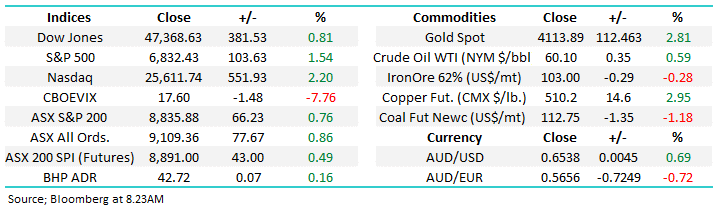

Overnight US stocks recovered strongly from their intra-session lows in another volatile session as investors continue to weigh the impact on economic growth from efforts by the Fed to rein in surging inflation. The S&P500 has already recovered ~90% of last week’s losses and MM continues to believe we are in a period of healthy consolidation before another leg higher.

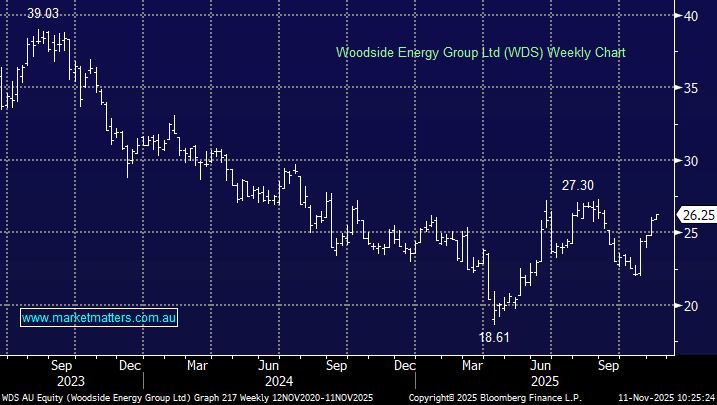

The SPI Futures are calling the local market up +0.7% this morning with energy stocks likely to lead the line although the retailers may struggle after Target Corp. (TGT US) cut its profit target for the 2nd time in just 3 weeks.