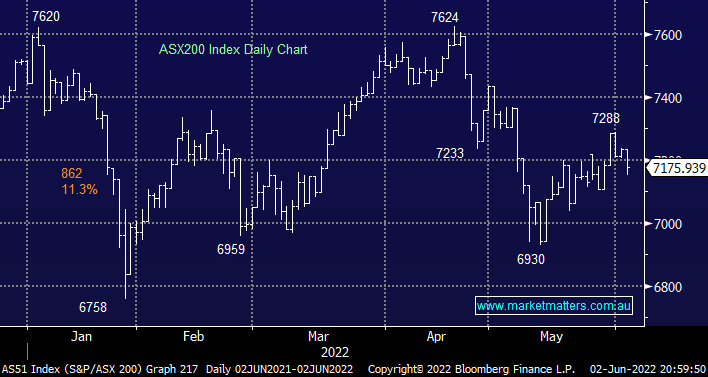

The ASX200 ended Thursday down -0.8% on broad-based selling, only 20% of the index managed to close in positive territory with the gains focused on the energy names plus a relatively small bounce by the battery metals stocks that were hammered on Wednesday. With the exception of the Utilities Sector, there was nowhere to hide although the decline felt more like a lack of interest by the buyers as opposed to aggressive selling e.g. only 4% of the index fell by more than 5% whereas on Wednesday we had the same number of stocks plunge by over 10%. The tech stocks were again the weakest link falling over 2% following strong US economic data reigniting fear of more aggressive rate hikes over the coming 12-18 months.

- The ASX200 IT stocks have fallen significantly harder than their US peers over the last 6-months and now they’re struggling to embrace any bounces by the FANG stocks et al, a concerning read through medium-term.

One of the largest influences on global stocks over the last 24 hours has been from JP Morgan CEO Jamie Dimon who made some pretty bearish comments about the US economy and stock market – “You know I said there are storm clouds but I’m going to change it….it’s a hurricane”. His comments sent the S&P500 Financial Sector tumbling lower including his own bank, the concern is that the US economy is struggling to evolve from fiscally induced growth to quantitative tightening weighed down by extra pressure from the war in Ukraine, in our opinion, this is all true but how much is built into equities after the aggressive 6-month fall by global growth/tech stocks is the million-dollar question.

- MM’s sticking with our broader medium-term view that de-risking portfolios into bounces makes sense as central banks embark on a clear path of aggressive rate hikes.

The very reasons expounded by Jamie Dimon have already caused a correction in risk assets which has been amplified by the high valuation growth names however these compressed valuations will by definition provide investors with opportunities at some stage of the cycle for businesses that can grow their earnings, sounds easy but that’s not always the case when the economic landscape performs a 180-degree pirouette. We mentioned yesterday that “On the last 8 occasions when the US hiked rates in a similarly aggressive manner to which they are today a recession was avoided only 38% of the time i.e. it’s worse than a coin toss” we believe this statistic alone currently warrants a more conservative portfolio than at any time over the last 10-years.

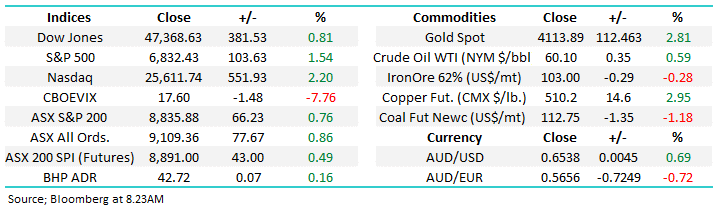

Overnight US stocks rallied strongly with the S&P500 closing up +1.8% with gains focused in the “risk on” names i.e. Tech & Consumer Discretionary. It was encouraging to see stocks rally on very little news as the US index closed at its highest level since the first week of May, the SPI futures are calling the ASX200 to open up over +1% this morning close to fresh highs for the week.