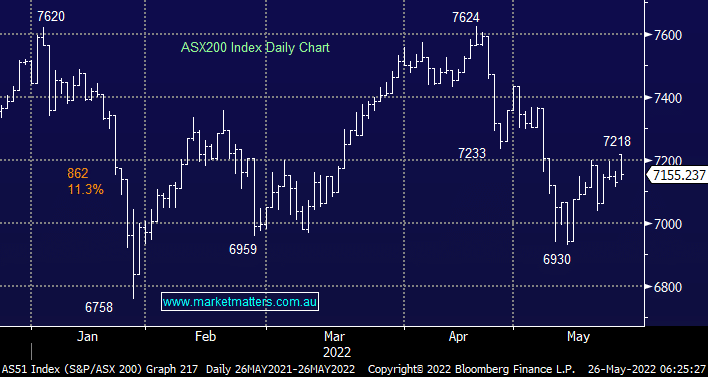

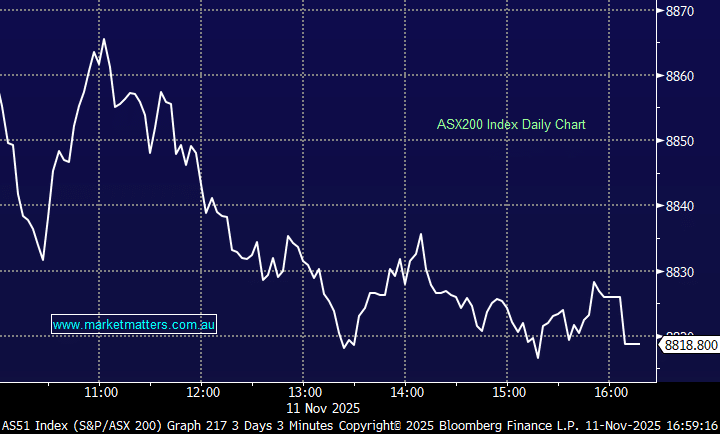

The ASX200 eked out a reasonable +0.4% advance yesterday although unfortunately the gains were halved in the match courtesy of some aggressive selling in the SPI Futures – clearly the short-term money had little faith that the US market could recover from the negative sentiment delivered by Snap Inc’s (SNAP US) ~40% plunge on Tuesday night. The local rally on Wednesday was again very stock / sector specific with the banks, energy and gold stocks looking good while tech was again clobbered same trend, different day.

However one tech dog might be about to shine, in less than 2-years artificial intelligence stock Appen Ltd (APX) has been smacked 85% trading like a classic growth rerating story but on steroids. The beleaguered software business is now said to have attracted interest from an overseas player, its certainly a lot cheaper than it was now trading an Est. valuation of 14.6x 2020 earnings. The word is the company has received a serious +$1bn approach, perhaps this could finally be the catalyst to renew investors interest in the severely out of favour IT Sector. So far in 2022 APX is in the middle of a very average pack of severe underperformers but with a 10% short position this morning could see a significant short squeeze:

- Year to-date APX has fallen -43% but amazingly it’s still managing to outperform 28% of stocks in the Australian IT Sector.

This week has seen a number of muted economic data prints out of the US which supports our slowdown narrative i.e. bond yields to drift lower. New Home Sales plunged -16.6% month on month to its lowest level since 2020 while the Manufacturing Index fell to 57.5 from 59.2. The stock market cannot decide whose its biggest enemy, higher rates or slower growth – the last decade would imply rates are the key. Encouragingly the latest Fed policy meeting gave no indication that officials are likely to turn more hawkish anytime soon:

- The headline comment was that 0.5% rate hikes look appropriate at the next 2 meetings.

- The market has now forgotten about potential 0.75% hikes and are pricing in risks to a combined 1% hike in June and July.

- Moving forward the Fed could now revert to 0.25% hikes as they look to become data dependant.

Overnight we saw US stocks rally in a volatile session as players digested the middle of the road Fed minutes, the tech based NASDAQ was the standout index rallying +1.5% although the consumer discretionary and energy stocks performed even better. The SPI Futures are calling the market to open marginally higher this morning although some left over selling felt around in the futures.