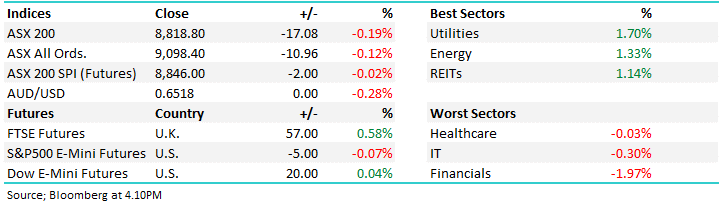

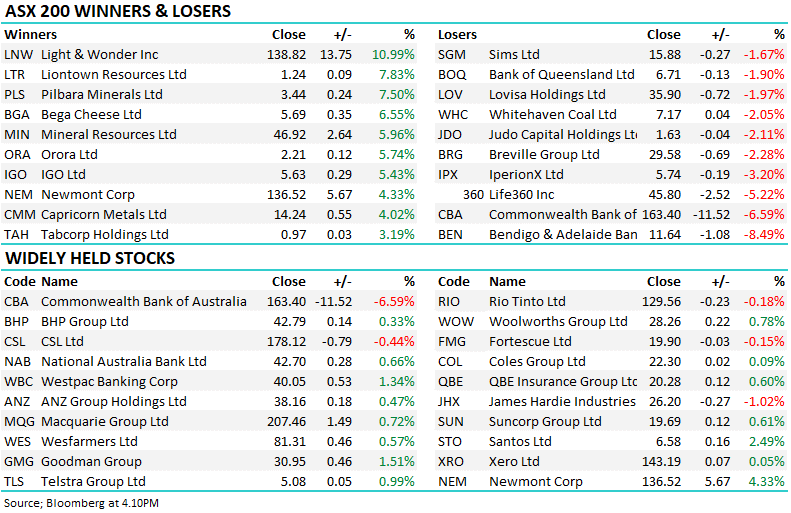

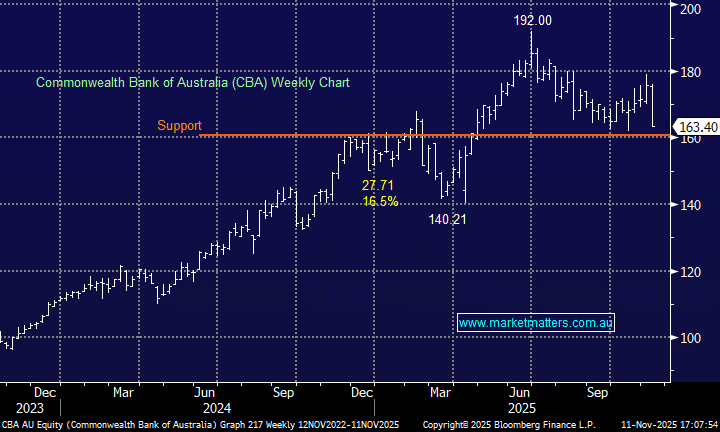

The ASX200 was clobbered -1.65% yesterday following savage declines on Wall Street, only the healthcare & gold names caught any semblance of a bid while consumer stocks followed their US peers sharply lower around concerns of rising wages / operating costs. Equities are continuing to adjust to higher inflation and interest rates but we believe it’s now predominantly fears of a potential recession on the horizon that’s become investors’ main focus, as we approach the mid-point of 2022 MM feels we probably need a sniff of slowing inflation before markets can find a meaningful bottom.

- We already have stagflation today but what comes next is the million-dollar question i.e. Stagflation is the painful combination of low economic growth and rising inflation.

We saw another strong economic release yesterday with unemployment falling to its lowest level in almost 50-years, it might help Scott Morrison on Saturday but the statistic can be interpreted in different ways:

- The impressive 3.95% unemployment rate will give the RBA confidence that it can hike/normalise interest rates without derailing the strong Australian economy.

- Employers are struggling to find staff which is pushing up wages fueling an already surging inflation backdrop.

Local interest rates are expected to rise again in 2-weeks’ time but importantly we believe a recession will be unlikely when people are both working and sitting on a huge post-pandemic war chest of savings. If our assessment is correct 2022 could easily be a year of two halves with markets improving after the current nervousness and volatility fade away but we do continue to believe that any strength will be very stock/sector-focused.

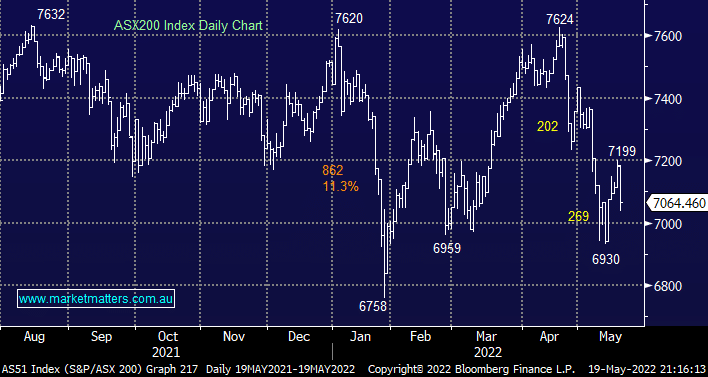

Our preferred roadmap for the current descent remains on track i.e. one final washout towards 6800 before the valuations become too attractive for the cash-laden investors however this wouldn’t be a view MM would be too committed to in today’s choppy market which could just as easily see us testing all-time highs in a few months’ time.

Overnight US stocks had a choppy session which finished with the S&P500 closing down 0.6%, the SPI Futures are calling the ASX200 to open slightly lower but the resources look likely to be a positive standout with BHP closing up over 1% on the overseas ADR’s and gold/oil both rallied strongly.