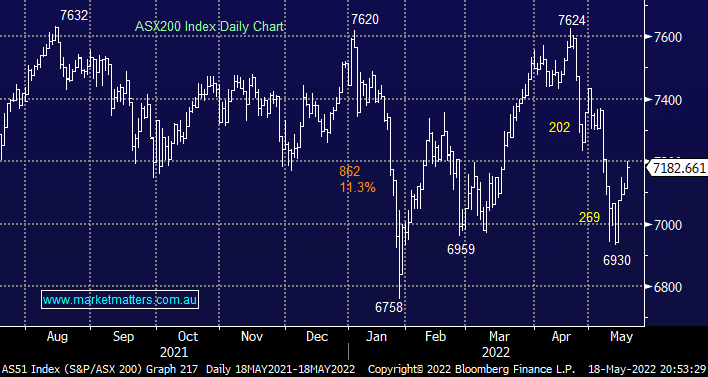

The ASX200 enjoyed a strong “risk-on” session on Wednesday which resulted in a gain of 1% fuelled by over 70% of the main board advancing, gains were led by the recently underperforming Resources, Consumer Discretionary and IT Sectors while selling was noticeable in some of the traditionally more defensive names – a day early after last night! The index has been range-bound between 6750 and 7650 for almost 15-months and yesterday we closed basically exactly in the middle of the range, whatever technical methods some subscribers may prefer it’s hard not to have a neutral bias towards the underlying index whereas beneath the hood the story has been different on the stock and sector level due to a number of major macro events.

Overnight the Bank of America released their Fund Managers Survey which MM believes delivers an excellent insight into investors’ sentiment and on occasion dangerous crowded trades:

- Investors have increased their cash levels to the highest in 20-years and it’s now amazingly the asset class which investors are the most bullish on, that’s extreme bearishness when we consider that interest rates are still very low.

- Allocations to tech are now at their lowest levels in 16-years while towards stocks in general they’re back at levels not seen since the panic during the coronavirus outbreak in 2020 i.e. cash levels have popped from 5.5% to 6.1%.

- In the April survey investors were 6% overweight stocks now they are at an extreme 13% underweight with hawkish central banks and a global recession cited as the largest fears.

- The most crowded trade is still long oil and commodities although the latter has endured a sharp correction over recent weeks.

Interestingly, most of the financial press is currently saying something similar to MM over recent days i.e. we are at extreme levels of bearishness but the markets ideally lacking a final capitulation. We like to keep things simple and after correcting over 9% on a crescendo of bad news we have an open-minded neutral to slightly bullish bias toward what comes next:

- After buying IGO Ltd (IGO) yesterday MM is basically fully committed to stocks in our Flagship Growth Portfolio.

- If we do indeed see another leg lower, towards the 6800 area, MM is likely to move up the risk curve e.g. sell a defensive stock and increase 1 or 2 of our higher beta positions.

- Conversely if the local market keeps rallying above 7300 it will generate a bullish trigger but we are likely to slowly lighten our tech exposure outlook into such a move.

Overnight US stocks endured one of their largest falls in over 2-years while the $US and bonds rallied as investors chased safe havens higher. The S&P500 fell over 4% with consumer shares tumbling over 6% led by Target Corp which tumbled more than 20%, delivering its worst 1-day performance since 1987, as rising costs led to a downgrade. The mega-cap tech stocks also came under renewed pressure with Apple (AAPL US), Amazon (AMZN US) and Facebook (FB US) all falling over 5% – when Apple falls this hard it’s a great sign that the selling has become indiscriminate in nature. The SPI futures are pointing to a -1.9% drop this morning taking the index back under 7100 but still within the last year’s trading range.