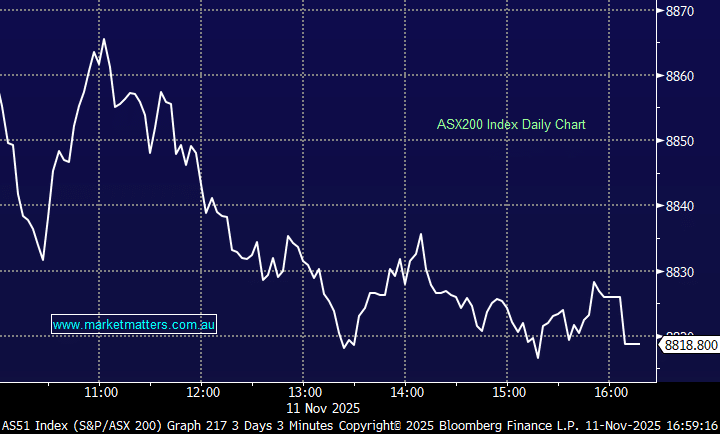

The ASX200 fell another 1% yesterday although we finally saw some bargain hunters enter the market mid-morning after a ~$1.75bn dollar stop appeared to be triggered in the SPI Futures as we finally saw some signs of panic capitulation style selling – traders usually look for such moves before calling a market bottom. The recovery was reasonably broad-based as we went from only 2% of the ASX200 being up on the day to 33% come the close with a number of high beta growth stocks catching a distinct recovery style bid tone e.g. REA Group (REA) +5.5% and Xero (XRO) +4.2%.

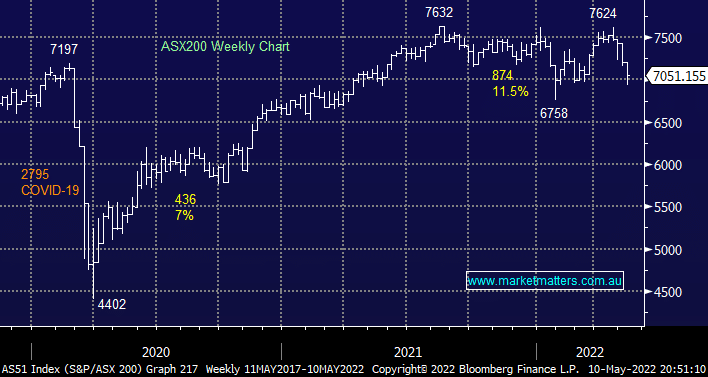

Considering the plunge by most global indices and of course hype throughout the press around inflation, interest rates, property prices etc the local market has held up remarkably well with the main index only down -5.3% this year before we consider dividends. The ASX200 is still basically smack in the middle of the last 13-months trading range with the value stocks remaining the markets backbone during 2022’s global outperformance:

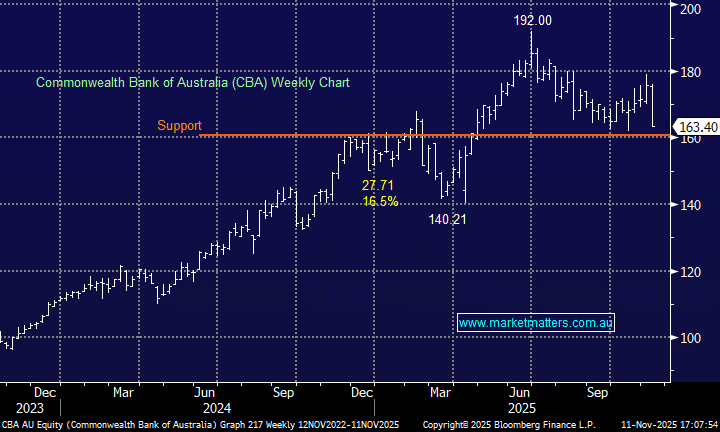

- Westpac (WBC) made fresh 6-month highs this week while heavyweight Commonwealth Bank (CBA) is up a few percent year to date even after paying a major dividend in February.

- Woodside (WPL) has surged 44% in 2022 while BHP Group (BHP) can hardly be called a laggard being up +11% year to date again after paying a hefty dividend in February.

The Resources Sector has already started to show signs of breaking down but so far the banks have been immune. We often joke that the market won’t go up / or down without the banks but it’s not as flippant as its sounds with the “Big 4 Banks” making up about 20% of the index i.e. if they had plunged in a similar manner to the tech stocks the index would probably be trading sub 6500. As we mentioned earlier the futures compounded index losses by around 80-points yesterday between 10.05am and 10.20am following a huge stop being triggered around 7000, this selling would have led to massive “arbitrage” selling across the main board as the computers had a field day:

- Arbitrage: Tuesdays aggressive selling sent the futures market plunging aggressively below its fair value, the arbitrageurs which rely largely on computers these days, simply would have bought futures and sold stocks simultaneously in a dollar neutral volume i.e. 1 SPI Futures Contract at the time s the equivalent to 1x7000x$25 = $175k which clearly equates to a large sell order when we consider 10,000 lots were sold. These traders will unwind/reverse the position when normality returns and volume starts trading in the SPI at or above fair value.

All stocks bounced after 10.30am but it felt like we saw some book squaring hit the growth stocks, it feels too early to call it bargain hunting but for this to follow through in a meaningful manner we need to see bond yields at least consolidate their 2022 gains. Interestingly overnight we saw tech stocks bounce +1.3% while the value-based Dow slipped marginally hinting that a similar reversion may have started in the US.

Overnight US stocks stabilised led by a bounce in tech stocks ahead of tonight’s key inflation data, it felt like the market wanted to rally on a few occasions before it reminded itself that inflation pressures remain a very real problem. This year has already seen $US9 trillion wiped from US equities as one by one different sectors have followed tech / growth names lower, this morning the SPI is pointing to a flat opening with BHP drifting a few cents in overseas trade.