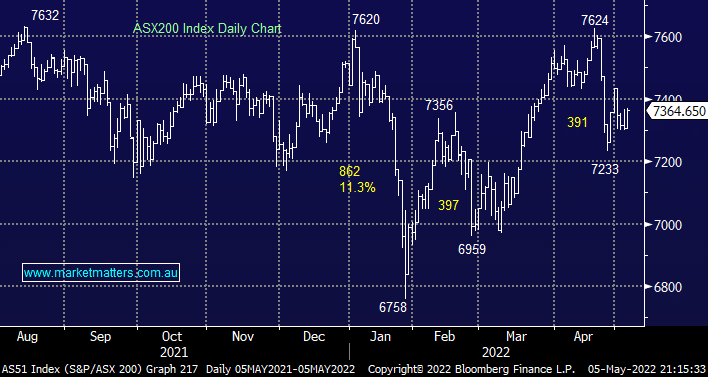

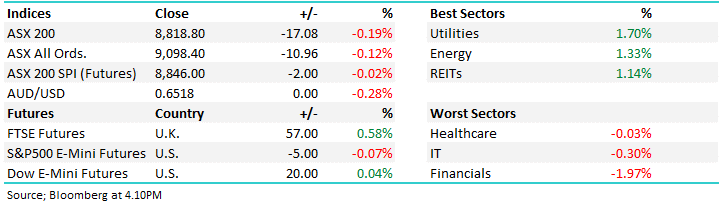

The ASX200 embraced the Feds milder rhetoric on Wednesday night and in particular their comments which suggested that aggressive 0.75% hikes were unlikely through 2022 i.e. interest rates are going up but not as fast as many feared. Local bond yields retreated substantially on the news with the 3-years falling almost 0.25% from Wednesdays 3.17% high, MM has been looking for bond yields to consolidate their strong advance over the last 5-months and this week’s rate hikes by the RBA & Fed plus not too hawkish comments feel like they may have heralded such a move:

- The RBA have raised rates for the first time in over 11-years from 0.1% to 0.35% with guesstimates that they will end 2022 somewhere between 2.5% and 3%, not a great Christmas present for mortgage payers, we are at the conservative end of the spectrum.

- The Fed announced their largest rate hike since May 2000 with the targeted range lifting from 0.5% to 0.75-1%, guesstimates here are that they will end 2022 somewhere between 2.5% and 2.75% by Christmas.

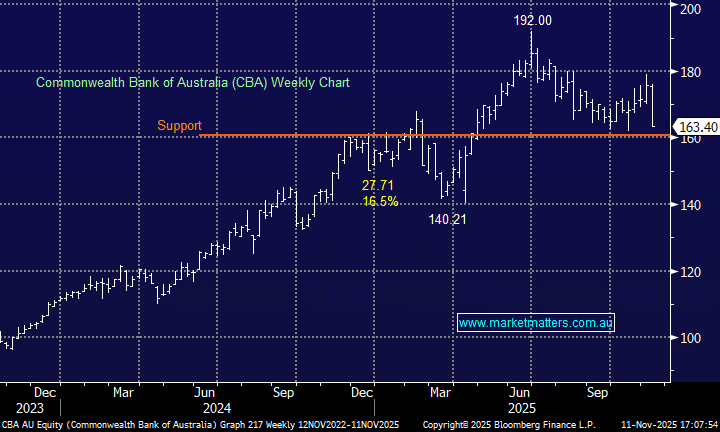

We feel central banks now have their cards on the table and although rates are clearly going higher over the next 12-months it will be no surprise and we feel the market is susceptible to a “sell the rumour buy the fact” style period:

- US tech has corrected 24% since late 2021 and investors are now carrying their largest underweight exposure to the sector in well over 15-years.

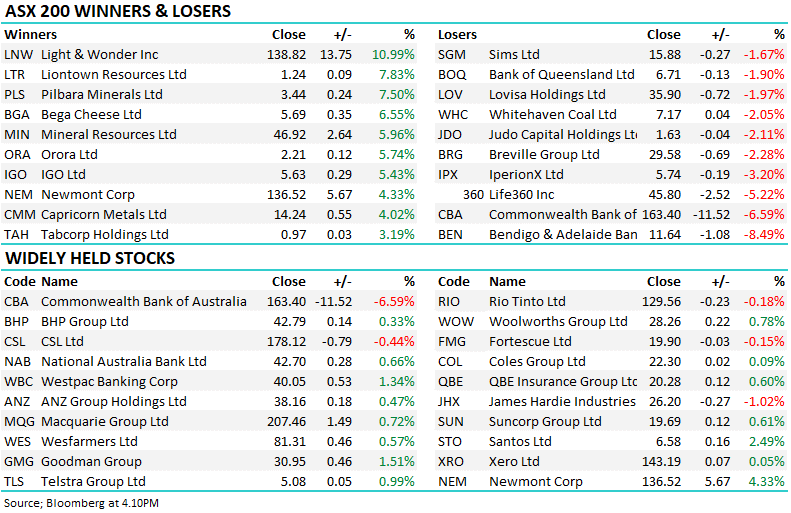

- Conversely fund managers are the most overweight commodities in history, a position that’s already weighing on the sector e.g. BHP has already fallen 16% from its late April high.

It doesn’t take any complicated extrapolation to summarise that if bond yields do stabilise and global growth slows just marginally we can see some meaningful rotation from the resources into tech, it may just be a rotational blip in the current bigger picture new global trend out of growth stocks but the sector swings could be meaningful. Growth names such as tech have dominated global equities post the GFC and they can fall much further, but markets rarely move in one direction without countertrend moves.

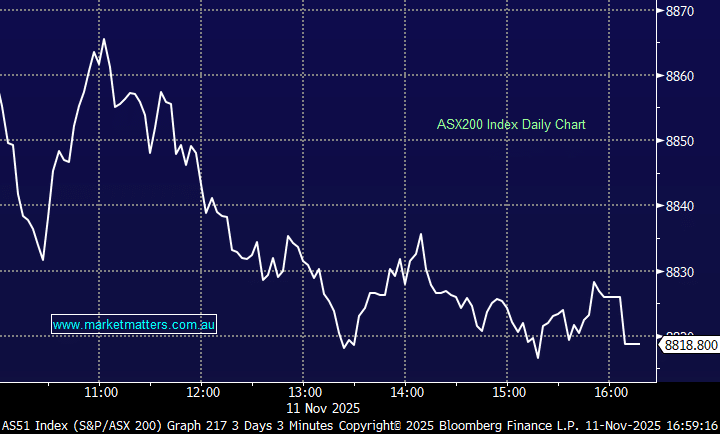

Overnight we saw US stocks reverse all of Wednesdays gains plus a little more with the Dow falling over 1000-points and tech stock plunging over 5% as concerns the Fed could win the battle against inflation and a recession was looming flooded through risk assets. In one of the sharpest U-turns ever – the day after surging the most in over 2-years – fears of stagflation rocked stock prices with over 95% of stocks falling – the consumer discretionary sector was the worst performer closely followed by tech. We’ve been looking for a bounce in tech which is still not happening but our call for ongoing volatility most certainly is! The SPI futures are pointing to a -1.5% fall this morning with BHP closing down $1.20 likely to weigh on the market.