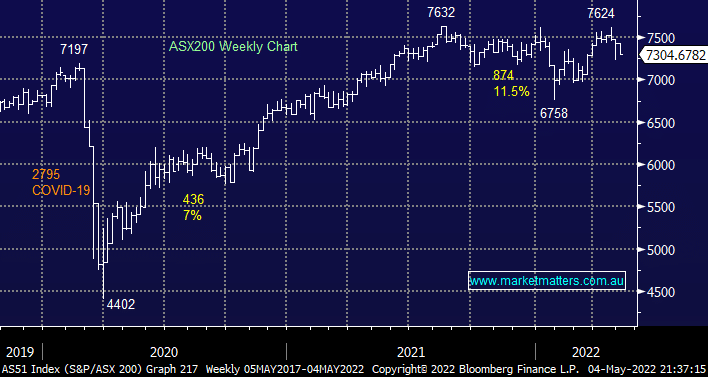

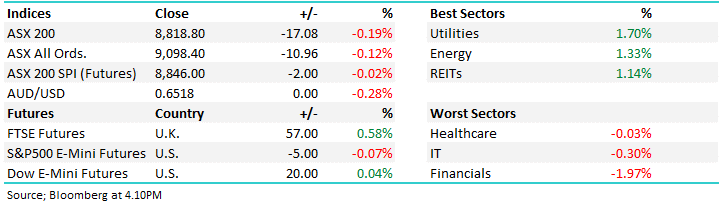

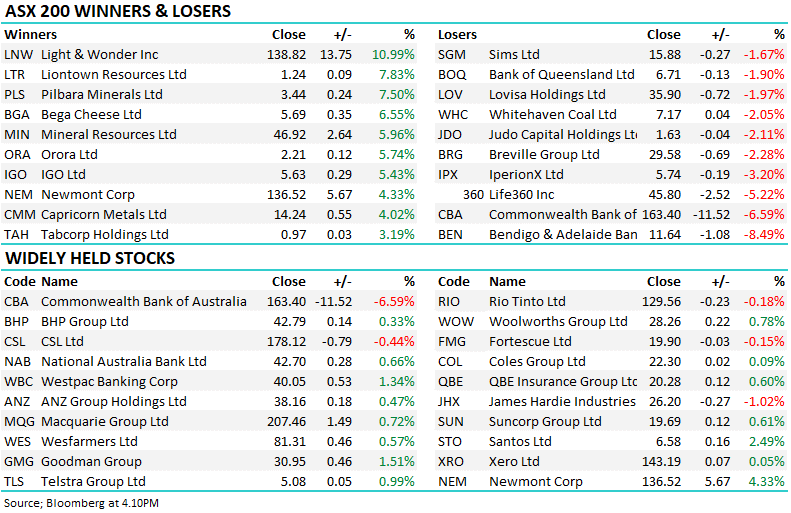

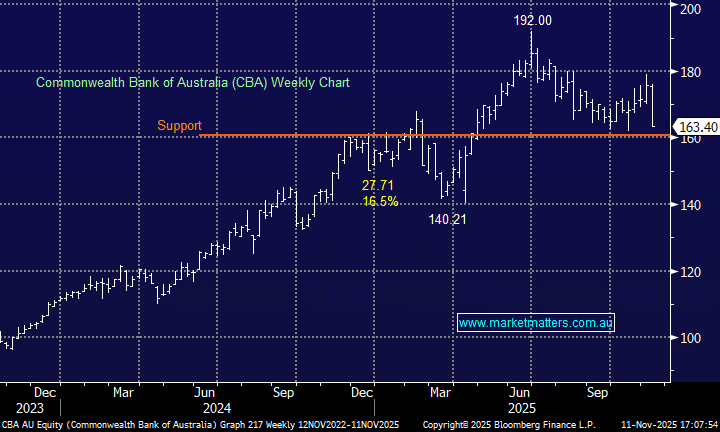

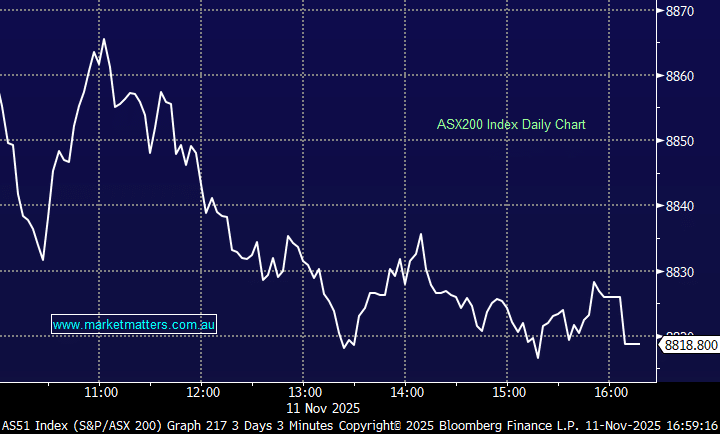

The ASX200 failed to hold onto early gains yesterday which was a disappointing performance following a solid result from ANZ Bank (ANZ) which helped the influential Banking Sector buck the markets trend i.e. the “Big 4” posted an average gain of 0.7%. However the resources stocks, amongst others, drifted lower throughout the day damaging both sentiment and the index in the process, investors feel more comfortable selling pockets of market strength as opposed to buying weakness although we shouldn’t jump too aggressively on the medias “bear bandwagon” considering the local markets still only 4.3% below its all-time high after being hit with a barrage of macro headwinds through 2022.

Interestingly, Macquarie believes that central banks will be forced to reverse their 2022 rate hikes sooner rather than later due to economic weakness courtesy of aggressive rate hikes plus the withdrawal of government stimulus. We’re not sure if they are correct but we do see ongoing rapid changes throughout financial markets in both relative sector performance and sentiment as volatility remains elevated for stocks and other assets, hence why not bonds!

Interest rates continue to dominate the press and unfortunately I cannot imagine anything changing until we see the back of this month’s election:

- Traders are changing their view on the likely path for Australian interest rates through 2022/23 almost like the weather, the futures markets is currently looking for additional hikes from todays 0.35% to 2.9% by Christmas – ouch!

- The Liberal Party & Scott Morrison appear to have an uphill battle over the next few weeks with the TAB having them at 3-1 underdogs – fortunately this time around Labour haven’t discussed tinkering with our franking credits.

Overnight, the US Fed hiked interest rates by 0.5% as expected and while Jerome Powell flagged similar moves this year he eased recent concerns that 0.75% moves were becoming increasingly likely, i.e. with regard to hikes over 0.5% he said “not something that the committee is actively considering”. The relatively moderate rhetoric led to the $US falling the most in 2-months and US 10-year yields dipping back under 3% two moves which helped precious metals and oil rally strongly, while US stocks surged on the comments from the Fed Chair – the tech based NASDAQ leading the pack gaining +3.4% while the Dow advanced +932-points, almost managing to register a 4-figure gain.

This morning the positive sentiment looks set to help the ASX200 to rally +0.4% early on, still well under where we opened yesterday morning.