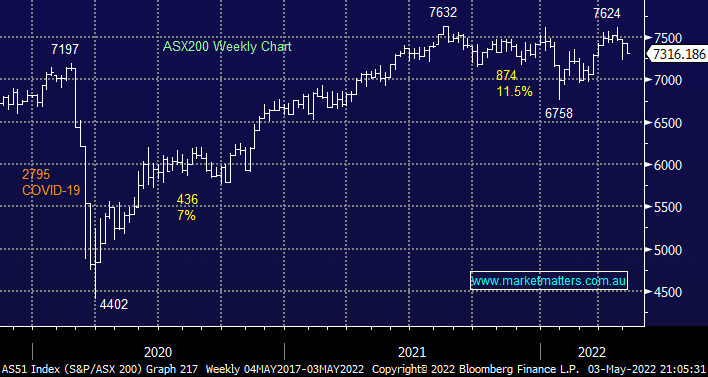

The ASX200 fell -0.4% yesterday as the RBA hiked rates slightly more than expected to 0.35% but interestingly we saw the value stocks dip slightly while tech in particular enjoyed a strong session. However, interest rates have been destined to go higher for months and while yesterday’s move was more aggressive than most economists anticipated it was always a matter of when and how fast as opposed to if they were going significantly higher. The need for the RBA’s record ultra-low COVID 0.1% rate is well and truly in the rearview mirror and MM believes the RBA effectively-acknowledged they’ve let themselves get behind the curve at 2.30 pm, on Tuesday:

- I’m sure Scott Morrison will be informing us all that Australia’s headline inflation at 5.1% remains well below the 8.5% rate in the U.S. and the ~7% in Europe but it’s going to be a tough sell come election day on May 21st.

- Capital markets are now pricing in a cash rate of 2.5% by the year’s end, our feeling is this might be a touch rich as it implies a frequent number of 0.25% & 0.5% hikes throughout this year.

- By September 23, current market pricing jumps even further to a cash rate of 3.68% which is very aggressive and well above economists’ expectations which are nearer 2%.

Global central banks have finally started to address spiralling inflation but it’s the whims of President Putin and the depth of China’s fresh COVID lockdowns that are arguably most likely to determine the effectiveness of their actions i.e. if we see another surge in commodity prices and extensions to supply chain disruptions then, unfortunately, rising inflation is likely to remain largely unchecked. In our opinion, the RBA has been too slow off the mark commencing their interest rate normalisation but ironically just as they are suddenly sounding very hawkish if we see a quick resolution to the Ukraine conflict and China realises the follies of its ways towards COVID they might have to perform yet another 360 degree turn towards their fresh inflation outlook i.e. lots of guesswork at play currently.

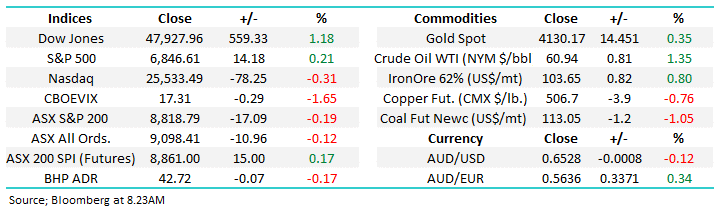

Following in the RBA’s footsteps the Fed is expected to hike rates 0.5% tomorrow while the market is pricing in a huge 10 hikes in the US this year, it’s not surprising that global growth stocks have endured a tough 6-months as the backdrop of “free money” has turned sharply. The only slight compensation for investors as we approach the mid-point for 2022 is an aggressive series of rate hikes is already priced into equities.

Overnight US stocks had a solid session as they awaited the Fed’s decision with the S&P500 rallying +0.5%, the SPI Futures are mirroring these gains almost perfectly pointing to a +0.5% gain by the ASX200 early this morning which should wipe out yesterday’s rate hike drop in a quick fashion.