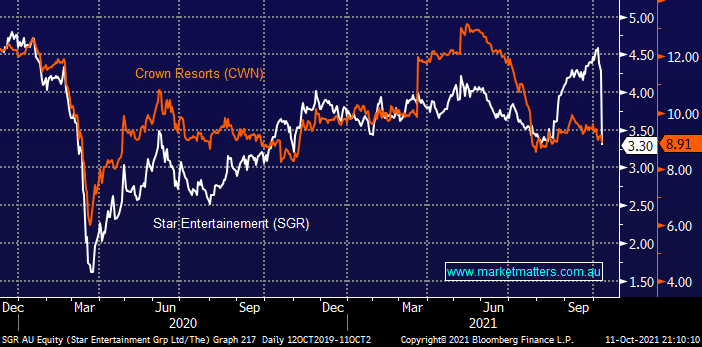

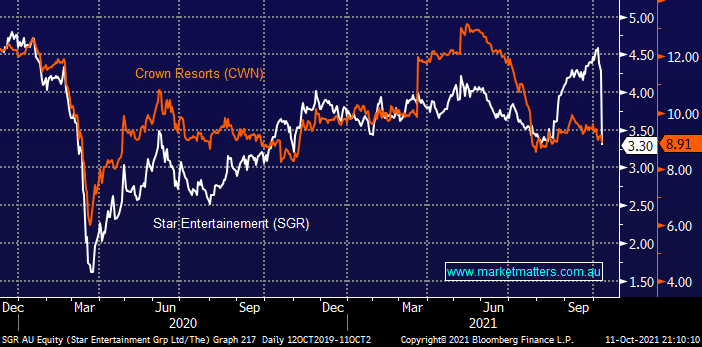

Only last Friday we noticed SGR slipping lower while CWN rallied reinforcing our preference for the embattled CWN but as we often say “what a difference a few days makes” in this case Star Entertainment (SGR) has fallen under the scrutiny of the regulator following claims to similar wrongdoings as at rival and previous target CWN – the allegations aired on 60-minutes and subsequently the press wiped almost $1bn from the stock’s value in 1-day, painful! Our view has understandably matured over recent months:

- We still believe both casinos will be operating in 2022 aided by the States need the revenue but they will undoubtedly be cleaner and hence less profitable.

- Our fair value for CWN with its licence in tact is over 30% higher but by definition there is plenty of event risk at present.

- We still prefer CWN to SGR but there’s no longer a large valuation gap between them.

- The way forward for both could be a tie up that affords greater scale and costs efficiencies across the larger group – we know Star were keen before this news broke.