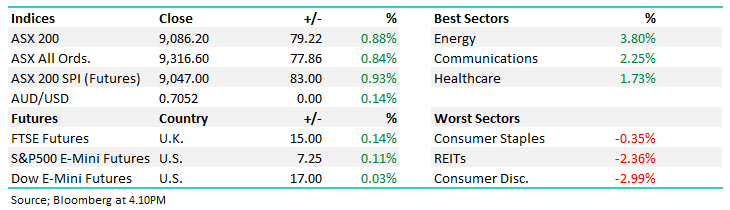

The ASX 200 fell 0.9% on Thursday, a win compared to the melt-down unfolding across global markets. The key takeaway from Trump’s much-discussed global tariffs is that the US now risks a recession this year, and inflation could surge, a worrying combination for equities. The only positive on the day was that markets have increased bets that the Fed will cut rates further through 2025 despite the possible uptick in inflation. Credit markets are now pricing in nearly four rate cuts by the Fed into Christmas. Ironically, US equities and the dollar bore some of the worst selling on speculation the president’s trade offensive will stunt the American economy, which is certainly understandable – tariffs are ultimately bad for growth, the US looks to have kicked an own goal, for now at least.