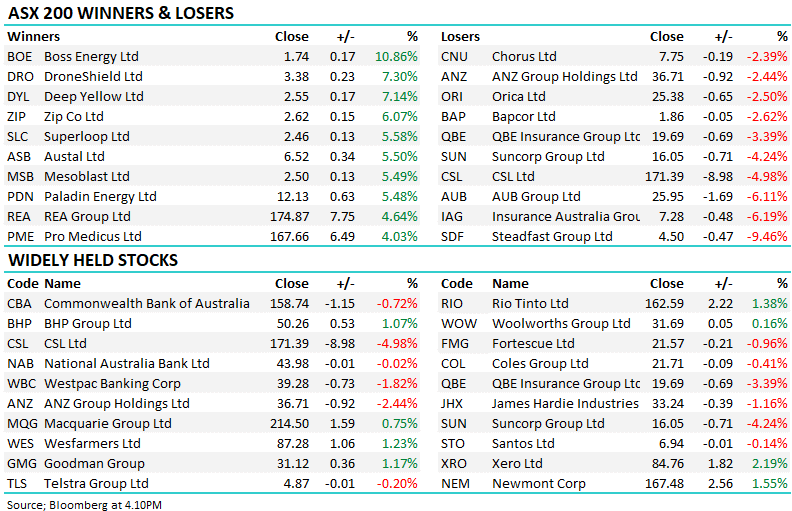

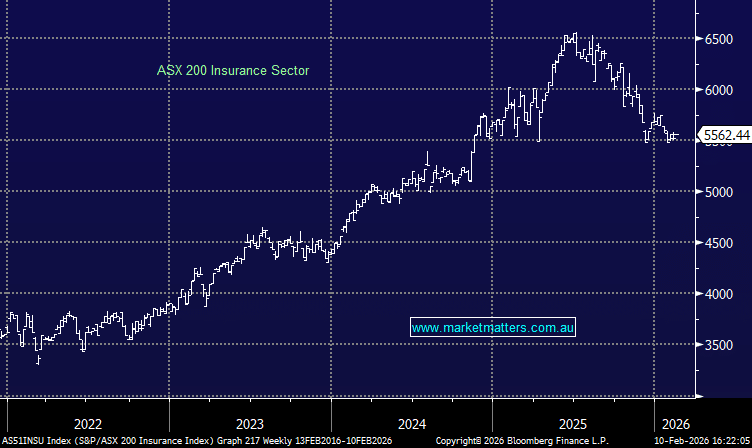

The Match Out: Insurance stocks become latest AI casualty as ASX edges lower

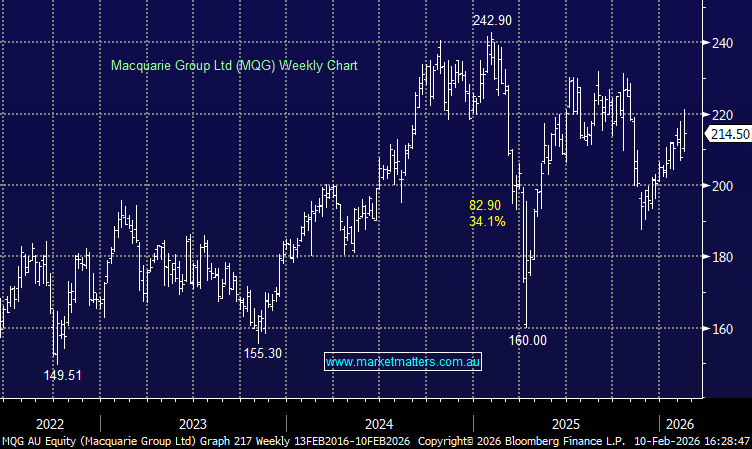

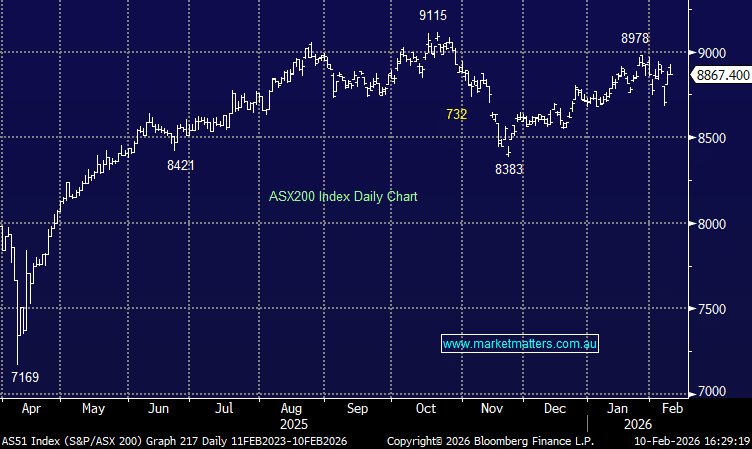

A mixed session for the ASX played out under the hood today with tech the clear standout and miners remaining firm after a strong start to the week as the bourse closed on the low of the day and almost +60pts from its high. Insurance stocks were hit as fresh fears emerged around AI disruption in the insurance-broking industry, with banks following suit into the afternoon.