Hi Michael,

IPO’s have been big business in 2021 with 85 companies listing in the first 6-months for a total raise of $3.5bn. I can understand the look and feel of your observation but there are a couple of important points to bear in mind:

- Firstly the best listings are often very tightly held with access often only through the brokers conducting the IPO – it’s much easier to get your hands on the likely losers!

- Secondly we have been in a bull market for most of the last 15-years hence lots of stocks have risen, not just the successful IPO’s.

MM believes investing in IPO’s should be evaluated in a very similar to any other stock on the ASX but by definition I do acknowledge they are usually priced to sell / be successful with the occasional stinker thrown in. Yesterday was a prime example of there being no such thing as “easy money”, Paytm plunged 26% on its 1st trading day after becoming India’s largest ever IPO.

The other thing I would call out is a recent move by huge US venture capital firm Sequoia, who manage large amounts of money for pension and endowment funds. They are changing the way they manage money (which is a massive undertaking) so they can continue to own shares in companies they invested in pre-listing, after they list. There is a good podcast on this topic (Invest Like the Best with Patrick O’Shaughnessy: Roelof Botha – Sequoia’s Crucible Moment on Apple Podcasts), with the key takeaway being that for true large scale growth companies, most of the upside comes after the listing and patient money is rewarded.

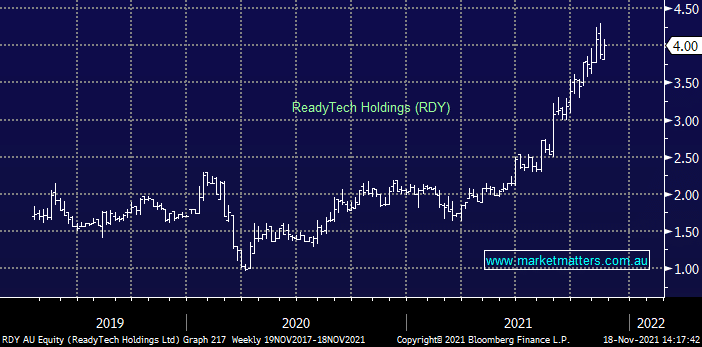

An example of that is ReadyTech (RDY), a stock we’ve followed closely, its IPO was largely a muted event however the true growth has come with access to capital.