US stocks listed in the US

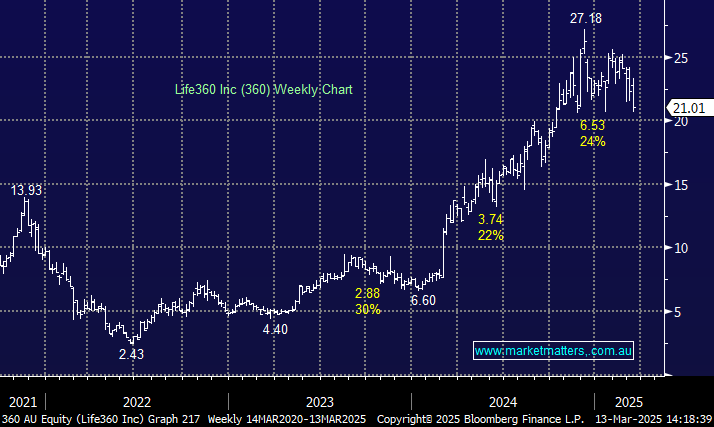

first of all you guys should be proud of the product you are putting out. Trying to get my head around what is happening in the USA for Australian listed stocks. Not after advise but thoughts. KPG is buying into practices, and repatriating profits, is this a no no ie repatriating profits, even though you are doing business in USA. Life 360, duel listed, HQ in USA, is this good. SPZ, Australian listed, no business in Australia but expanding in the USA, do they pass muster. So just looking for USA facing stocks that may have legs. Thanks Terry