Hi Deb,

We have largely steered away from YAL due to it being a complex coal and dividend play due to its ~75% ownership by two Chinese entities, which as we saw in 2024 can influence their decision-making processes – out of nowhere they froze August dividend despite reporting a profit of over $400 million and holding a $1.55 billion cash balance with no debt. At the time the company was reportedly considering an acquisition of Anglo American’s Queensland coal operations, prompting it to conserve capital for potential corporate activities.

However, they subsequently paid a 52c fully franked dividend in February with 40c projected for this August, the stock is forecast to yield a whopping 15% fully franked yield.

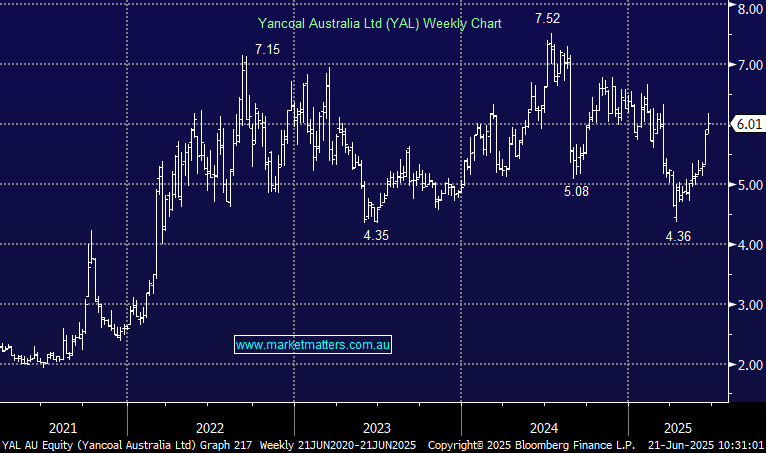

- We are net bullish YAL targeting a break of $7 plus a healthy yield with the caveat of risks around Chinese ownership.