Hi Scott,

A few moving parts in this question:

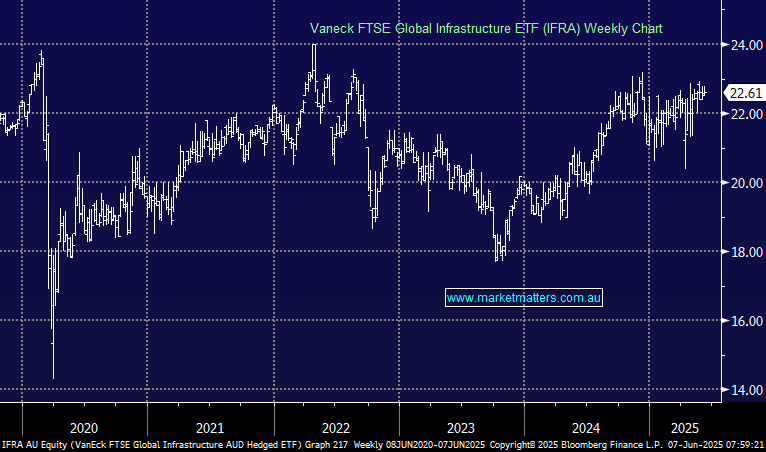

We hold the Vaneck FTSE Global Infrastructure ETF (IFRA) in our Core ETF Portfolio hence the obvious answer is yes to whether infrastructure should hold a weighting in a diversified portfolio, of course it comes down to what and when but this ETF has given MM a steady return since our purchase in 2023.

- Infrastructure funds offer stable and predictable income with a low correlation to bonds & equities. Plus, they are usually hedged against inflation while offering long-term growth, an attractive mix. For people not familiar with these ETFs just think Transurban or APA Group as types of investments held.

In terms of the ClearBridge Global Infrastructure Value Fund Active ETF (CUIV), this is an active investment strategy rather than an index tracking one. It’s new on the ASX but the underlying fund has a longer track record. Because it’s an active strategy, they charge a higher management fee of 0.97%. The same is true for Resolution Capital Global Listed Infrastructure Fund (RIIF) – it’s a new listing of an active strategy charging a management fee of 0.70% p.a. plus a performance fee of 20% of the Fund’s outperformance.

The IFRA on the other hand is a true index tracker, based off the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index allocating 50% to utilities, 30% to transportation (including railroads and airports), and 20% to other infrastructure sectors such as pipelines and telecommunication. Geographically, it’s predominantly United States (57.8%), followed by Canada (11.0%), Australia (6.7%), Spain (6.5%), and the United Kingdom (4.2%). It is also hedged, and while this has detracted from returns when the AUD has fallen in recent years, our outlook is this will change, and a hedged strategy will outperform. At 0.2% per year, it is more economical, and it will track the index making it more vanilla. The other two rely on fund managers making good investments.