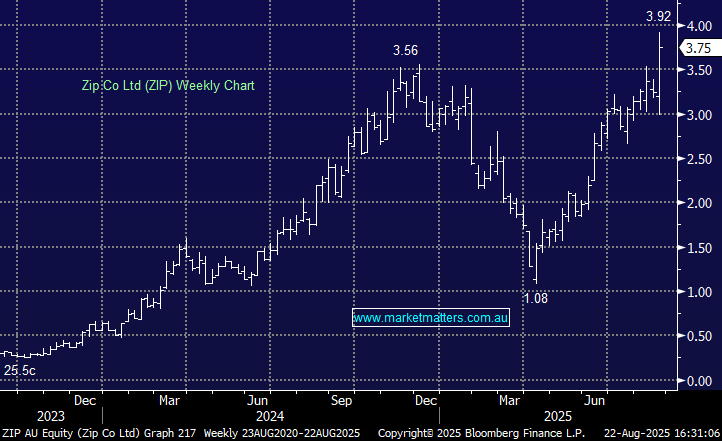

ZIP +20.19%: Jumped on a strong FY25 result beating consensus earnings and FY26 guidance, primarily driven by stronger-than-expected US transaction volumes.

- EBTDA of $170m, a 6% beat vs consensus

- US TTV grew +45% yoy in 4Q25, with active customers up 11% to 4.25m.

- ANZ TTV growth lifted to 14% yoy, with Zip Plus now 12% of AU receivables.

Looking ahead, guidance points to FY26 cash EBTDA of ~$230m, 6% ahead of consensus, with upside if operating leverage improves. The market will remain focused on their US growth and how they mitigate bad debts, which ticked up over the last quarter.

Boosting sentiment further, the market swirled over a potential Nasdaq listing which aligns with increasing brand recognition and uptake in the US while satisfying an improving appetite for Buy-Now-Pay-Later stocks, proving to be a successful formula, case and point ex-Aussie listed Sezzle which is up 15x fold since 2023.