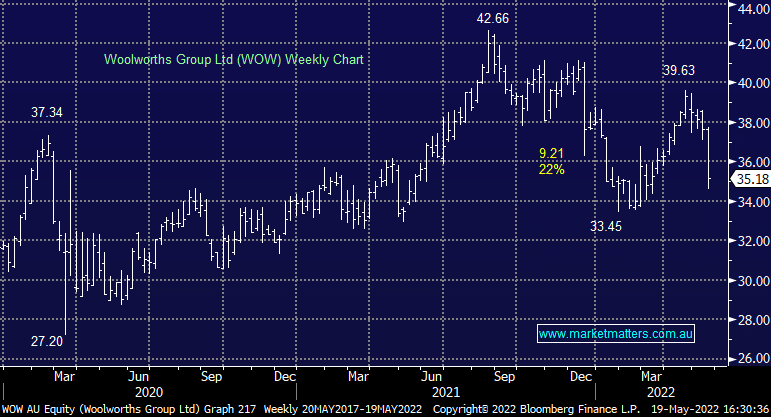

WOW -5.61%: it’s not often we see ‘Woolies’ down nearly 6% however the negative sentiment flowing from Target’s result in the US prompted a significant sell-off right across the retail sector in Australia, and not even staples were spared. Rising costs are the main issue here however it’s important to note that WOW and other sector players like Wesfarmers (WES) have not enjoyed the strength that the likes of Target have in the US which has seen their shares rally 2.5x in the last 2 years.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

MM remains long WOW in our Flagship Growth Portfolio

Add To Hit List

Related Q&A

What to Buy/Accumulate

AMP, WOW, NEC

Woolworths (WOW) – A beaten up stock worth buying?

Is WOW entering the buy zone?

Does MM still like Metcash (MTS) after recent falls?

Are Coles and Woolworths relatively safe investments?

WOW and WES Bargains after sell off?

Are WOW and WES bargains after this sell-off?

Updated view on few battered up stocks?

Does MM like Woolies & / or Coles

Whats the benefit of Woolies (WOW) off market buy back?

The Major Supermarkets

What’s happening with Woolworths class action case

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.