The defensive supermarkets are also having a tough period not helped by poor reports from some US retailers hurt largely by wage pressures and supply chain issues impacting margins/profitability. However, we think it’s important to understand the difference between discretionary retailing and non-discretionary retailing, especially in an environment of rising rates – people do have to eat and the major chains such as Woolworths and Coles will have no issues over the medium term passing on price increases that are out of their control hence their revenue and profitability remain on firm ground if the economy deteriorates, however even while they may perform strongly across the Retail Sector it doesn’t mean their share price will be immune to weakness.

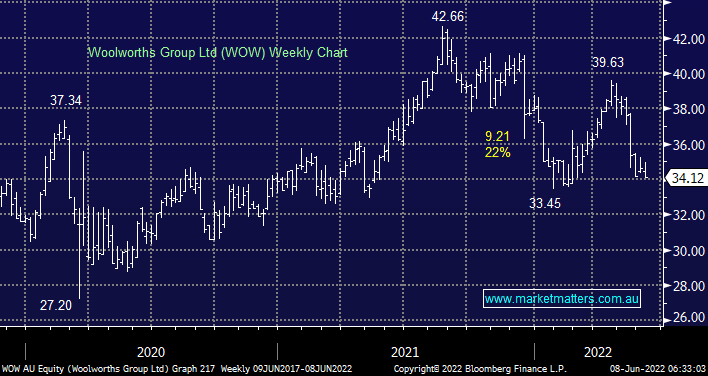

During the GFC caused global recession between 2007 & 2009 WOW fell -35%, if we see this mirrored through 2022/23 a test of the $30 area would be the result, we are comfortable with our 5% position in this household name but have no plans to increase the position unless we see another leg lower by the stock.