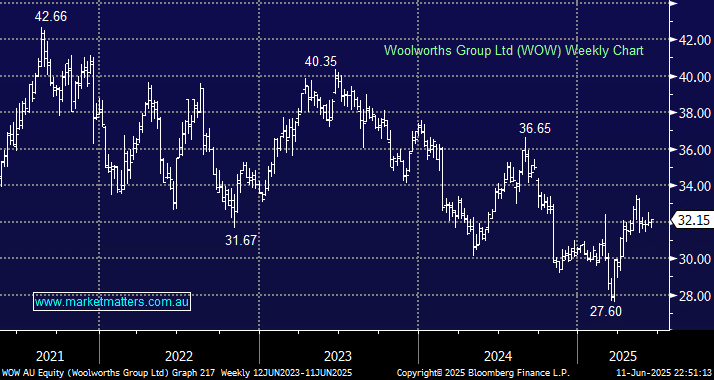

In today’s relatively rich market, WOW is still trading on the cheap side of the ledger, albeit just. We believe both WOW and COL have an exciting runway to cement themselves as e-commerce giants, but at this stage, WOW are leading the charge. Customers love the convenience of shopping at one destination, so just like Bunnings recently pushed into Petcare, the world could become WOW’s oyster if they secure our point of choice to shop online – remember Amazon used to sell only books! WOW is an obvious candidate for MM when we want to adopt a more defensive skew across our portfolios, thanks to its relative insulation from economic downturns. However, we think it’s starting to offer more than just a defensive role.

- We can see WOW regaining its “Mojo” over the coming years, implying its good value ~$32 – we have added WOW to our Active Growth Portfolios Hitlist.