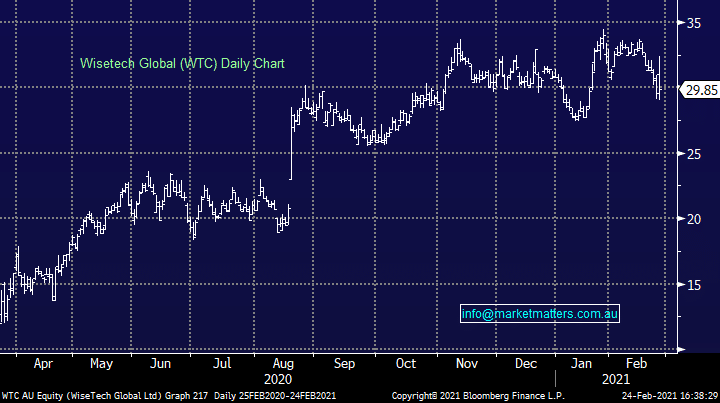

WTC released its 1H21 result and overall, it was a strong revenue number while they also did well on cost performance. These guys were impacted by COVID however the recovery is now well under way . FY21 revenue guidance was unchanged, but EBITDA guidance was kicked up by increased +6% and that’s what’s underpinning a slight uptick in the shares today, although they have come well off early morning highs. In terms of the numbers, FY revenue should come in between $470-510m (9-19% growth) and the increased EBITDA guidance implies to $165-190m (vs $155-180m prior).

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 15th August – Dow off -11pts, SPI up +8pts

Friday 15th August – Dow off -11pts, SPI up +8pts

Close

Close

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Close

Close

WTC still remains expensive and opaque, we have no interest around $30

Add To Hit List

Related Q&A

Wisetech

Turnaround Opportunities

The taking a loss lottery

Xero (XRO), Wisetech (WTC), Pro Medicus (PME), and ANZ Bank (ANZ)

MM view on WTC

Highest conviction calls after this weeks pullback

Is Wistech (WTC) a Hitlist candidate?

Why did WiseTech (WTC) get hammered this week?

MM’s view on WTC and MP1 please

Does MM like Wisetech (WTC) after its result?

What are MM’s thoughts on insider actions in WTC and PGH?

Does MM like Australian technology companies?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 15th August – Dow off -11pts, SPI up +8pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.