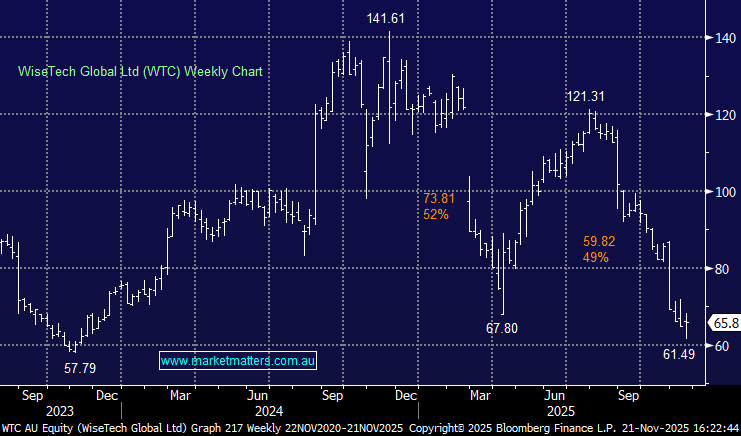

WTC +2.41%: Bucked the negative trend today after the logistics software group reaffirmed its FY26 guidance at their AGM, a much-needed dose of stability. From an operational and earnings perspective, the update was solid. But the story around the AGM was dominated less by CargoWise and more by ASIC investigations, board upheaval, a first strike on pay, and emotional scenes from co-founders Richard White and Maree Isaacs.

WiseTech kept all major metrics unchanged:

- EBITDA growth: +44% to +53%

- Revenue growth: +79% to +85%

- EBITDA margin: 40% to 41%

- Revenue: $1.39b–$1.44b

- EBITDA: $550m–$585m

The assumptions underpinning this outlook remain the same:

- CargoWise expected to grow 14–21%

- Includes $45–50m in one-off e2open integration, retention and break costs (worth 2–3pp of margin dilution)

- The company will add at least one new independent NED by 31 December 2025

From a numbers perspective, the reaffirmation is meaningful given how battered the share price has been – still more than 50% below its 12-month high. Despite all the noise, we think WiseTech remains one of Australia’s strongest structural growth stories – a global logistics software platform with clear competitive advantages and high-quality recurring revenue.

NB: Shawn added WTC as a trade today – here