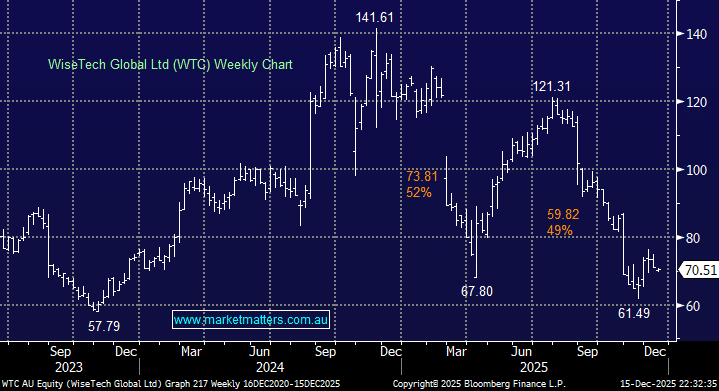

WiseTech is down ~42% so far in 2025 having been hit with a tsunami of bad news from a “billionaire behaving badly”, uncertainty around the integration of a high valuation takeover, and the markets general valuation compression across the space. Despite all the noise, we think WTC remains one of Australia’s strongest structural growth stories – a global logistics software platform with clear competitive advantages and high-quality recurring revenue. We’ve discussed the company many times this year, including a detailed deep-dive earlier in the month, here. Even after the stock’s recent 15% bounce, it’s still trading almost 50% below its 5-year average EV/EBITDA – it’s very rare to get an opportunity to purchase such a high-quality business at such levels.

- We believe WTC is already leading the recovery in the local tech names: MM holds WTC in its Active Growth Portfolio.