WTC holds a strategy day today, always important, but particularly so after a tough year. We expect no change in earnings, having reaffirmed its FY26 guidance at their AGM only two weeks ago, though we do expect them to lay out a clear strategic roadmap following the company’s large acquisition of e2open.

The AGM was an interesting event to say the least, dominated by ASIC investigations, board upheaval, a first strike on pay, and emotional scenes from co-founders Richard White and Maree Isaacs.

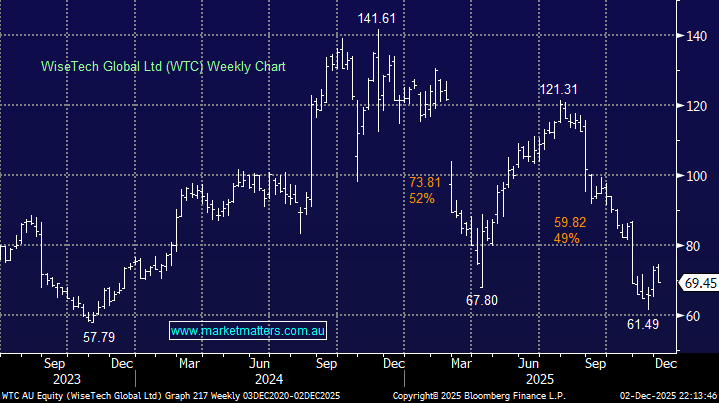

From an operational perspective, the reaffirmation of guidance was meaningful given how battered the share price has been; it’s still trading over 40% below its 2025 high. Growth is expected to continue with revenue tipped to jump +80% to $1.4bn in FY26 following the acquisition of e2open for $US2.1bn. Despite all the noise, we think WiseTech remains one of Australia’s strongest structural growth stories – a global logistics software platform with clear competitive advantages and high-quality recurring revenue, which is currently “going cheap” following a succession of indiscretions/events since late 2024:

- In October 2024, the founder and former CEO, Richard White, faced serious allegations of inappropriate personal conduct, including claims of sexual misconduct and bullying. White stepped down as CEO, transitioning into a “consulting”/“founder and founding CEO” role. The stock spiked lower but rallied back to post new all-time highs.

- Then in February 2025, WTC announced that four of its six board members, resigned, triggered by “intractable differences” over the continuing role of Richard White at the company, sending the stock down over 40% in a matter of weeks. Many investors viewed this as a vote of no confidence, not only in White’s personal conduct but also in the company’s willingness to safeguard shareholder value and reputation when the founder is involved – AustralianSuper exited.

- In August, WTC’s guidance and margin outlook disappointed markets after the acquisition of e2open, with concerns increasing over leverage, integration risk and whether the expected synergies will materialise.

- In October, the stock was clobbered again after media reports surfaced alleging more personal-conduct issues involving White, including claims that he had made questionable payments to a former intimate partner — allegations which triggered the company to launch an internal review.

- Later in the same month, officers from the Australian Federal Police and ASIC executed a search warrant at WiseTech’s Sydney offices with a focus on alleged improper share sales by White, plus three other company employees.

If the above list wasn’t enough, the sentiment towards WTC and the ASX tech stocks in general has been awful in recent months, but with lemming-like selling often comes opportunity. Two key points have MM regarding WTC as a deep value opportunity into 2026:

- It remains a world-class growth story, which we believe will continue to execute operationally, especially after the e2open purchase, making the current valuation an opportunity when the above tsunami of bad news fades away and is overtaken by improved earnings.

- Despite his personal indiscretions, Richard White remains an integral part of WTC, very important for in the e2open integration and AI revolution – last month’s AGM illustrated he’s still “All in” on WTC.

Investors are currently applying a “governance discount” to WTC, which, when combined with the ASX’s current rerating across the tech space, we believe has simply gone too far:

- WTC is trading ~48% below its 5-year average EV/EBITDA multiple – i.e. it’s as cheap as its ever been.

When indiscriminate selling washes through market sectors it creates opportunity and we believe that is exactly what’s unfolding in Australian Tech stocks today – it’s almost the complete reverse to the panic buying we saw in the “Certainty Trade” in 1H when the likes of CBA and JB Hi-Fi posted new all-time highs without regard to valuations. WTC is a business that enjoys a defensive moat to its earnings, being the only logistics software company with one unified global platform (CargoWise) combining workflow, compliance, and automation at scale, creating very high customer stickiness and global defensibility.

Growing through acquisition is WiseTech’s bread and butter, having previously acquired 70+ specialist companies to fill product gaps. The acquisition of e2open potentially transforms WiseTech from a leader in logistics execution into a full-spectrum global supply-chain software company, opening new markets, new customers, and powerful cross-selling opportunities. We believe investors are underestimating the potential for WTC to benefit from the much larger footprint across the global supply chain, afforded by the strategic purchase, as they adopt an if in doubt, stay out approach.

- We like WTC around $70, believing it has excellent upside potential when sentiment turns: we hold WTC in our Active Growth Portfolio.