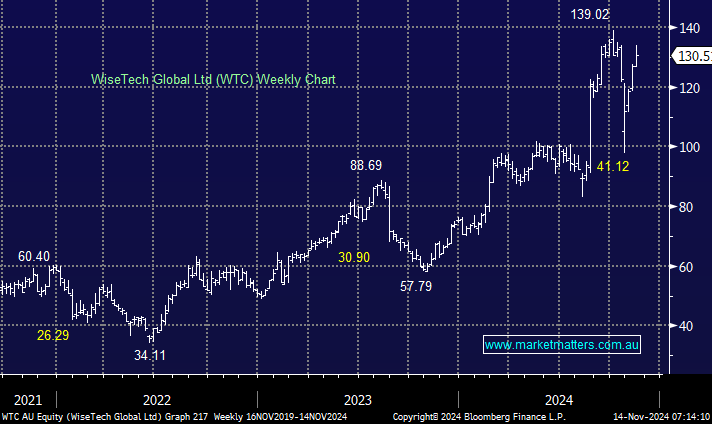

WTC was featured prominently in the recent ASX’s “Billionaires Behaving Badly” chapter, although it has recovered far better than Mineral Resources (MIN). However, yesterday, a law firm filed a class action against the logistics software group, claiming that WTC failed to tell investors that it was falling short of aggressive earnings targets after acquiring poorly performing businesses. Once you’re in the news for the wrong reasons, it often takes time to be given a break!

The risk for WTC comes with the appointment of a new CEO following the departure of founder and CEO Richard White from that position. Having made nearly 40 separate acquisitions since it IPO’d in 2016, we see strong potential for a few skeletons in the closet!

- We cannot see good value in WTC, considering the looming risks, and the current valuation is still on the expensive side of its own history.