- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

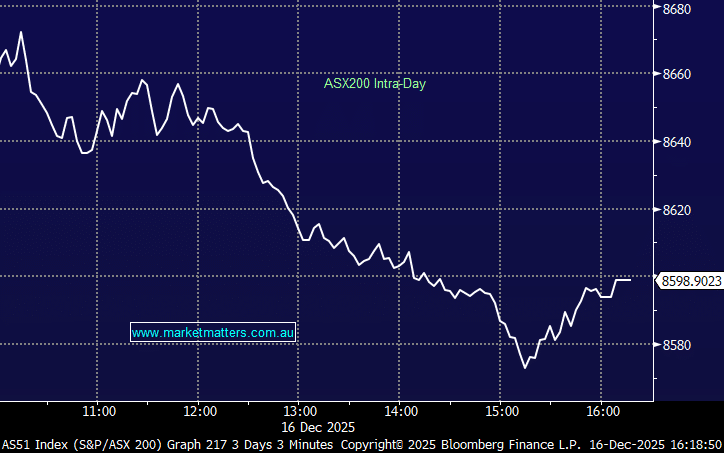

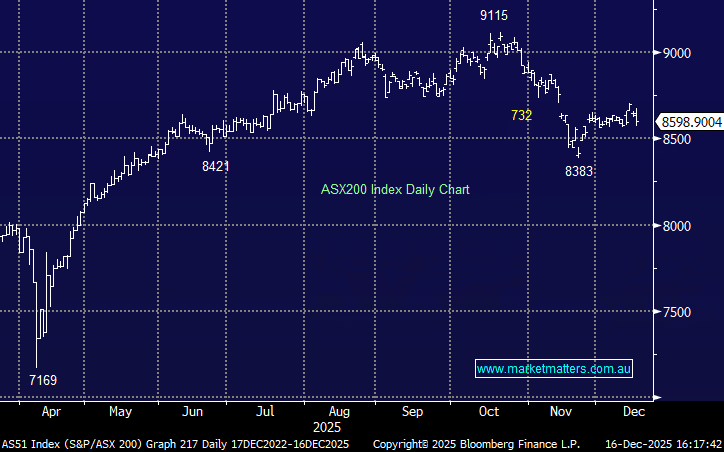

The ASX slipped into negative territory through the session as early strength in the banks was offset by sharp weakness across technology and energy stocks. Investors remained cautious ahead of delayed US labour market data for October & November due tonight, which could shape expectations for further Federal Reserve rate cuts into 2026.

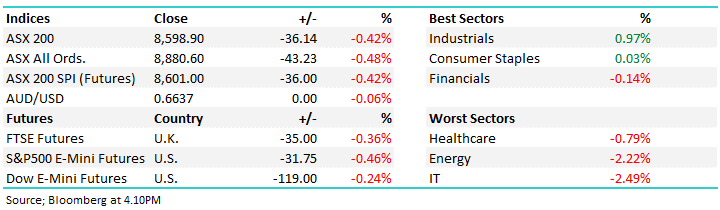

- The ASX200 fell -36pts/0.42% to close at 8598.

- Industrials (+0.97%) & Staples (+0.03%) the only sectors to end higher.

- IT (-2.49%), Energy (-2.22%) and Healthcare (-0.79%) the weakest links.

- NAB and CBA now expect a February RBA rate hike, citing capacity constraints and sticky inflation, while HSBC warned policy may already have eased too far.

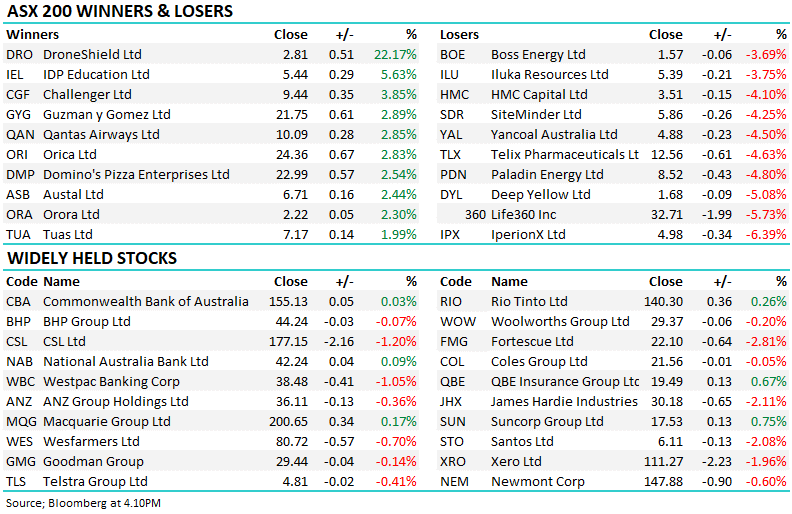

- Qantas (QAN) +2.9% as the airline returned to court over the distribution of a $40m penalty linked to outsourced ground handling.

- Life360 (360) -5.7% slid to five-month lows, now down ~41% from its July peak as valuation concerns persist across tech.

- IperionX (IPX) -6.4% weakened alongside broader risk-off sentiment in growth names.

- DroneShield (DRO) +22.2% rocketed after securing a $49.6m military contract via a European reseller

- REA Group (REA) -1.7% fell after Google moved to display real estate listings. Citi noted limited long-term impact given ~80% of traffic is direct.

- Zillow (ZG US) is a stock we own in the International Equities Portfolio that was hit on the same news – we covered this morning here.

- Southern Cross Electrical (SXE) +2.5% gained after winning ~$90m in new data centre and rail contracts in NSW.

- Star Entertainment (SGR) unchanged after announcing Bruce Mathieson Jnr as incoming executive chairman.

- Orica (ORI) +2.8% advanced after management flagged a strong start to FY26 with continued demand for explosives and blasting products.

- ASX Ltd (ASX) –2.9% fell after ASIC delivered a critical report into the market operator.

- Oil eased with Brent around US$60/bbl, pressured by optimism around Russia-Ukraine peace talks and softer Chinese data

- Gold was down $US21/oz at US$4,283/oz.

- Iron ore was up 1% at $US102.50

- US futures are lower as markets brace for delayed US employment data.