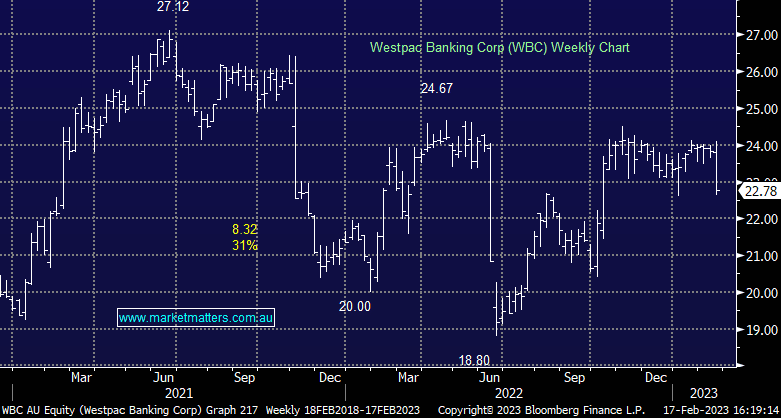

WBC +0.09%: Quarterly update today with limited financial details, although what we saw seemed okay. Their capital position, credit quality and funding are all inline with what you’d expect. They didn’t provide details about cost management, which is an important driver for WBC as they improve efficiencies. While we like ANZ & NAB in the space given 1. Valuation & growth via Suncorp & 2. A focus on business banking respectively, Westpac (WBC) is trading on the cheap side of history, about 1 standard deviation below its norm for both price to book & P/E as shown below.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM views WBC as cheap, although prefers ANZ & NAB

Add To Hit List

Related Q&A

Portfolio Construction

Question on banks

Bank Stocks

Banks – so strong!

Westpac (WBC)

Profit Taking

Where to on the Banks (Big 4 )?

Thoughts on Bank Dividends in May

What do you think of these shares

December Dividends

What are your Santa Rally Expectations?

Westpac Hybrids

Are Bank/hybrids safe?

Q&A for Sat Weekend report – Banking Sector (ANZ, NAB, WBC,CBA)

What’s MM current view on the BIG 4 Banks (ANZ, CBA, NAB, and WBC)?

Does MM like the 4 Big Banks (CBA,NAB,ANZ,WBC) into current strength?

Can Westpac ever get back to its highs?

MMs thoughts on Banks/hybrids

What are MM’s thoughts on the “Big Banks”?

Which Banks to hold

WBCPL 7.93% yield

What’s MM opinion on Westpac (WBC)

When to cut losses?

Westpac buy back – is it worth participating?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.