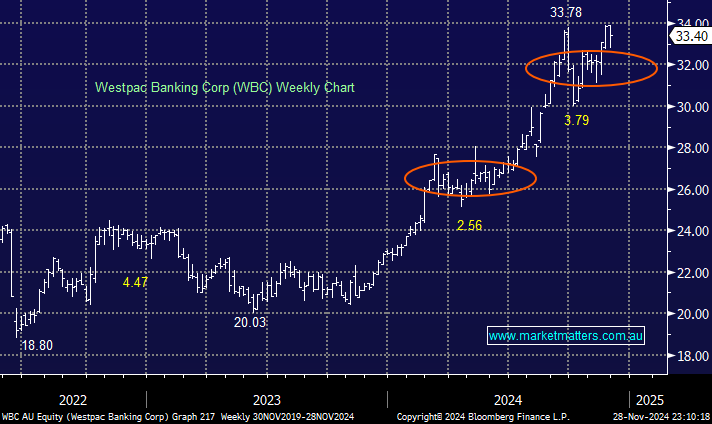

The banks are knocking on the door of fresh highs into the bullish Christmas period, with ANZ, NAB and WBC rewarding shareholders with their dividends later in December; all three traded ex-dividend earlier this month. This massive wave of cash from the banks and other companies usually helps lift the market into Christmas, making it a period where surprises are often on the upside. Hence, we can see a break above $34 into 2025, but we wouldn’t be chasing the likes of WBC at current levels.

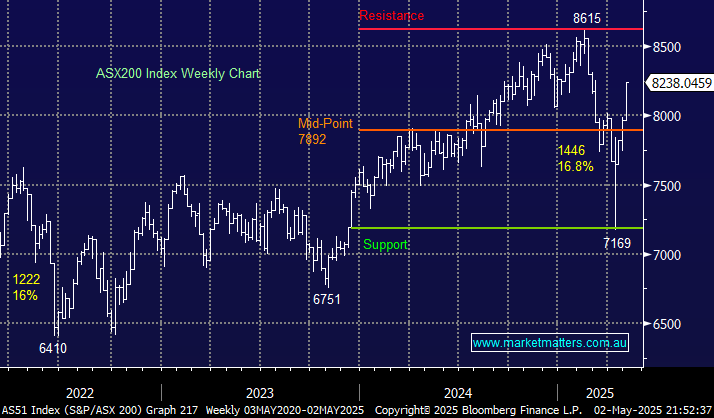

Despite a strong performance in 2024, with the ASX 200 Banks Index significantly outperforming the broader market, analysts are expressing concerns about sustainability due to high valuations and slow earnings growth projections. Key drivers for the sector’s performance include strong investor sentiment, higher interest rates, and stable property markets. The banks are currently benefiting from favourable market conditions, such as a reduced number of branches, a stable economy, the economies’ transition toward a cashless society, and improved AI efficiencies for those who get it right. However, the sector’s long-term performance will depend on how well it navigates operational costs, competitive pressures, and, importantly, the potential rebalancing of valuations.

- We don’t like the risk-reward toward WBC as it tests new highs; we can see another pullback on the horizon.