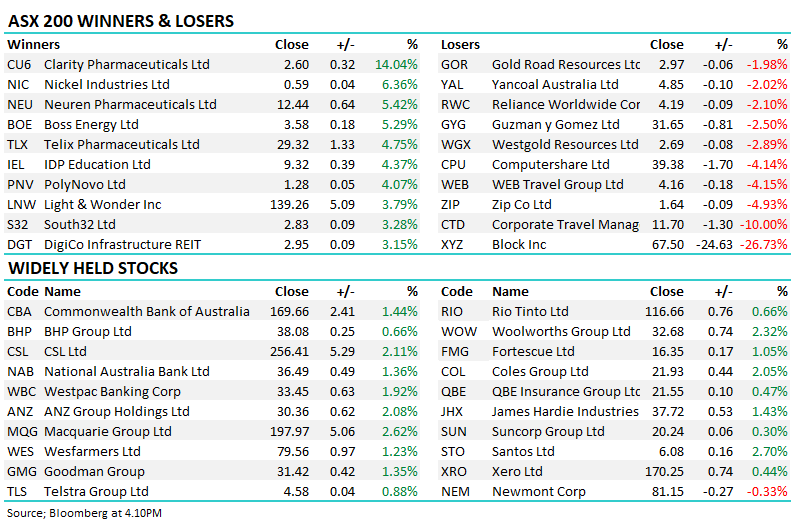

Westpac struggled early after delivering an FY24 result which was largely in line with market forecasts:

- NPAT of $6.99bn was in line with consensus overall but included a beat on bad debts but a slight miss on core earnings.

- A fully franked dividend of 76c will be paid later this week, which may disappoint some, but a fresh $1bn buyback largely offsets this.

- Net interest margin (NIM) widened to 1.97% from 1.89% from the first to the second half, despite fierce competition in the mortgage space.

The stock initially dipped on the result due to the lack of a special dividend, although we saw nothing of concern. WBC may face a challenging 2025 if/when Australian rates decline, but with everybody bearish, we’re concerned the market remains underweight in the sector: on WBC, analysts have 2 Strong Sells, 3 Sells, 7 Holds, and 1 Solitary Buy.

- We don’t own WBC, but it looks good, setting the stage for ANZ and NAB in the coming sessions.