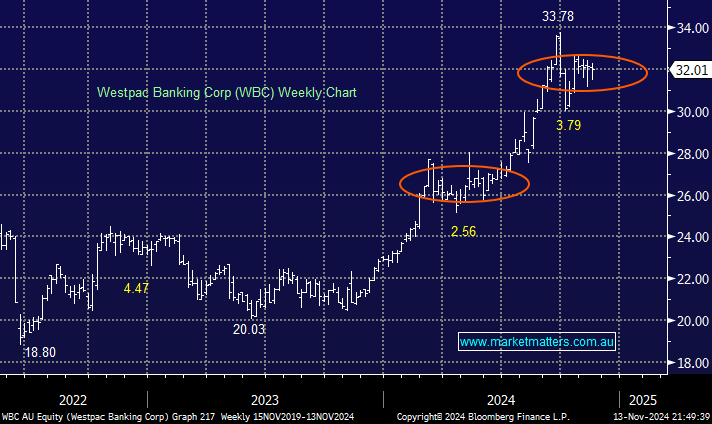

In recent months, we flagged WBC as likely to consolidate in a similar fashion to the 2Q; as the chart below illustrates, the call is on point so far. While WBC isn’t our top pick here and now, it’s not our least favoured (NAB is), and we can see a path forward where WBC could outperform. If WBC can increase its return on equity (ROE) to NAB’s level through its IT spend, above system growth, share buybacks, etc, perhaps it will the justify a Price/Book Value similar to NAB’s i.e. +30% higher.

- After trading ex-dividend 76c ff last week we like WBC into dips.