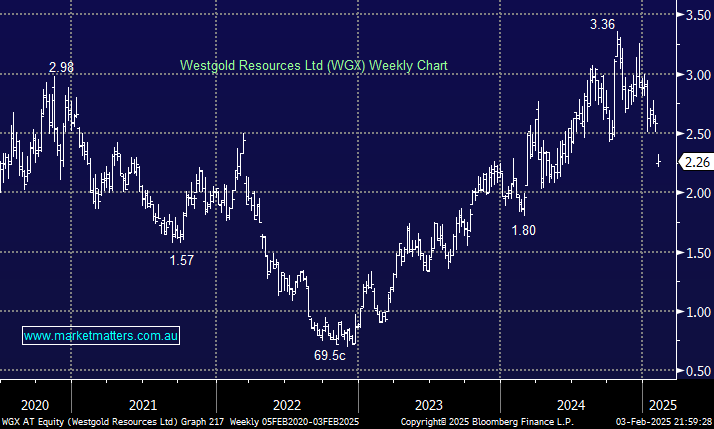

WGX was smacked over 12% on Monday after cutting its gold production for the full year. The ~17% downgrade in production and ~16% increase in all-sustaining costs/oz, to $A2,400-2,600 makes the drop in the share price appear reasonable. The downward revision in production was put down to disappointing ramp up from the Beta Hunt and Bluebird-South Junction underground mines. With gold posting all-time highs in January we aren’t keen to chase strength in the sector and would especially avoid stocks like WGX with operational issues – a break below $2 would not surprise.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

James on Ausbiz this morning talking markets

James on Ausbiz this morning talking markets

Close

Close

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral towards WGX

Add To Hit List

Related Q&A

Profit Taking

Playing Defence: Gold & APA Group

Whats MM’s view on 3 gold stocks please?

Why does Westgold (WGX) keep falling?

MM views on Gold

The energy sector + Westgold (WGX)

Relevant suggested news and content from the site

chart

James on Ausbiz this morning talking markets

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.