The S&P 500’s small gain overnight took it within 0.4% of its all-time high, an impressive result considering the fresh tariff uncertainty, combined with inflation data due out tonight and bank earnings due out later this week. Corporate America is bracing for its weakest earnings season since mid-2023, but lower estimates could prove easy for companies to beat. As US financial giants kick off earnings season tonight, we can envisage the old adage “under promise and over deliver” playing in many cases, a backdrop that could easily push the market to fresh highs. The week is likely to kick into gear tonight with the options market pricing in a 0.6% swing after tonight’s CPI (inflation) print, which will help determine the path for Fed rate cuts, or not, through 2025/6.

We also get earnings pre-market from JP Morgan (JPM) US), Citi (C US) and Wells Fargo (WFC US), ahead of Bank of America (BAC US), Goldman’s (GS US) and Morgan Stanley (MS US) pre-market on Thursday.

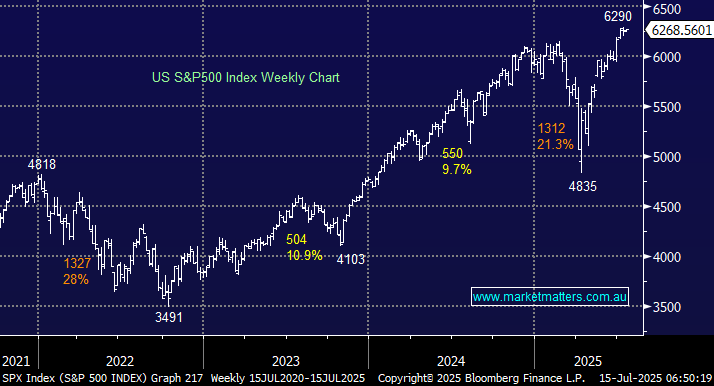

- We can see US stocks pushing higher in the 2H of 2025, but gains are likely to become more stock and sector focused.