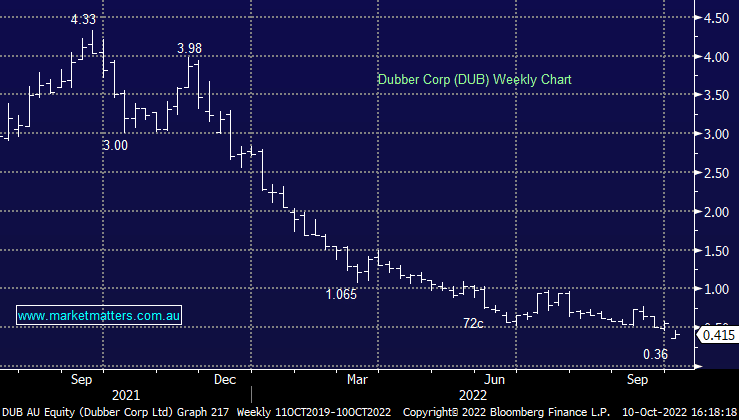

Dubber (DUB) returned from suspension today after releasing the final audited accounts for FY22 on Friday evening.

What Happened?

Dubber has released its annual report with several changes to both revenue recognition and one large aged debtor within the accounts.

1) FY22 service revenues now at $25.3m reduced by ~-$10m on the previous amount they had said (via their quarterly). It looks like the Auditor had an issue with the methodology being used and the timing of cash receipts. i.e. they make a sale, book the revenue, but cash comes in over time. It’s the recognition of this revenue that has been queried for FY22, although prior year (FY21) remains unchanged.

2) Write off for an aged debtor for over $8m within FY22. While they still deal with this client, because of the delay in payment they have taken the decision to write off the full amount in FY22 which is around $8m.

Are they broke?

No, but they need to improve ARR cash conversation and reduce cash burn. DUB exited FY22 with cash of $84m and an expense run-rate of ~$75-$80m. The CEO said they have enough money to fund the business, a clear direction to limit spending where possible and a strategy to get to breakeven.

What will happen short term?

We suspect the share price will be under pressure until concrete data around financial run-rates are provided for this quarter, the only real piece of positive news in the announcement was that cash receipts have been preliminarily flagged to have improved with a company record of $9.5m in 1Q-23.

What’s the MM take?

It’s a frustrating position to be in given the issues. For Market Matters, the technology and the opportunity stacks up but management have had to eat their words on revenue numbers. The CFO has departed on the back of the issues and perhaps this will provide the scorched earth opportunity in the stock and performance improves. The risks do remain high and execution will be key. We would have liked to hear more firm commitments from management around revenue targets, run rates and cost management on the call, and that’s the main reason we remain neutral.