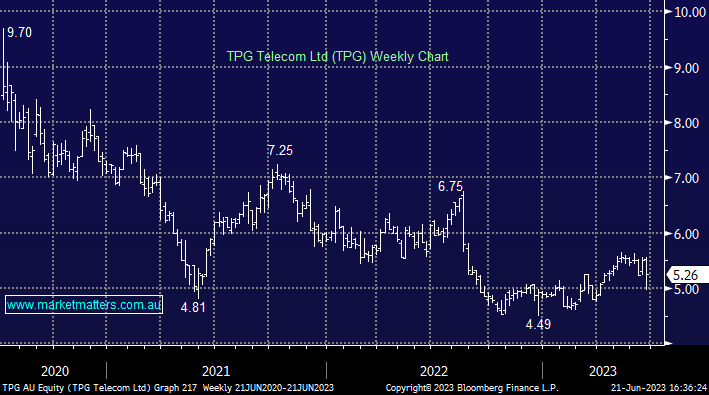

TPG -5.4%: struggled today after failing to overturn last year’s ACCC decision to deny an agreement with competitor Telstra which would have seen the two share the network in regional areas of the country. The deal announced in February would have vastly extended TPG’s reach and allowed many Australians an alternative to Telstra’s often more expensive mobile plans. The company maintained FY23 guidance which now includes $20-25m in one-off costs, however, the stock fell given it is facing a significant CAPEX bill to build out their regional offering, though these plans are likely to take time to implement. Shares bounced off intraday lows today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral to positive TPG

Add To Hit List

Related Q&A

The taking a loss lottery

Your opinion on TLS, TPG, PPT, APA for dividends

What are MM’s current thoughts towards OZL and TPG?

TPG vs TLS

Does MM still like TPG, RMD GMG?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.