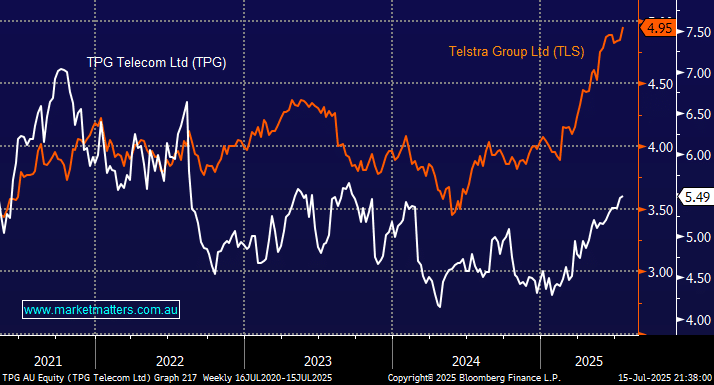

Over the last year, Telstra (TLS) has noticeably outperformed TPG, although they have danced in tandem so far in 2025, with both up ~22%. We don’t currently have any exposure to the sector in our Active Growth Portfolio, hence when talk of a potential capital return by TPG gathers momentum, we start to listen. Last week, the Foreign Investment Review Board approved Vocus’s acquisition of its fixed assets business, with the million-dollar question being what will TPG do with its ~$4.7bn in net proceeds from the deal. The telco has provided no specific clues, but we think it will be a combination of paying down debt combined with capital returns.

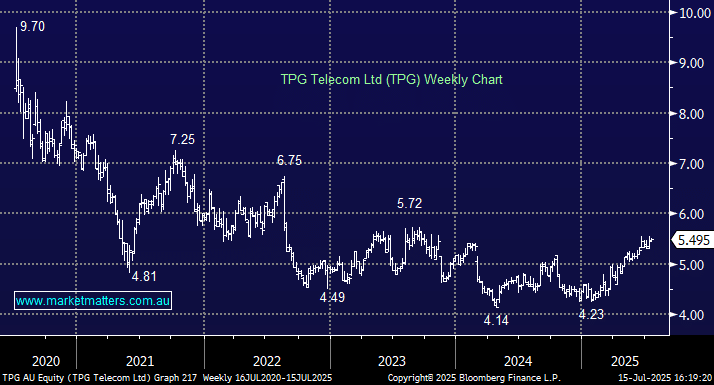

TPG have the equivalent of ~$1.50 of franking credits, so we assume a decent slice would come back through a fully franked distribution. This would be a huge bonus for Australian investors who’ve endured a tough few years with the stock down over 40% from its 2020 high. If all goes smoothly, TPG is likely to declare and pay a special fully franked dividend between September and November 2025, after closing the Vocus transaction. The board will confirm details at that time, but we feel it’s going to be attractive, with the only question being how attractive. While a buyback is attractive with the stock still on the cheap side of history, the franking balance can’t be ignored. Debt is an issue, and we have little doubt they’ll address this in the first instance before heading into the 5G investment cycle.

- We anticipate a blend of capital initiatives from TPG, but a $1 fully franked special dividend is a good chance and is likely to support the stock over the coming months.

However, to buy a stock MM needs more than one potential attractive capital return. TPG is evolving as more of a pure play mobile operator, arguably the best part of the telco industry where there is clear growth as prices rise. We believe TPG is becoming a more simplified business with sustainable leverage and a stronger growth profile, which should boost market appeal for a broader base of investors: we see plenty of room for broker upgrades, of the 10 brokers who cover TPG, there are 2 Sells and 4 Holds. We see minimal downsides at the moment for TPG, making it a prime defensive play with the ASX hovering around all-time highs – we have added TPG to our Hitlist.

- We like TPG ~$5.50, targeting a move towards $7, plus an attractive early Christmas present in the form of a likely special dividend.