We recently added TPG to our Active Growth Portfolio Hitlist in anticipation of a what the telco would do with its ~$4.7bn net proceeds from its Vocus sale. We were expecting a combination of paying down debt and capital returns, which could have been especially attractive for local investors as TPG have the equivalent of ~$1.50 of franking credits, hence a decent slice could’ve come back through a fully franked distribution. However, TPG have added another dimension:

- Reduce debt, around $1.7bn will be used to pay down debt.

- Shareholders will receive cash (up to $3 billion total) as part of a pro-rata capital return after a shareholder vote in October – estimates are ~$1.61 per share.

- TPG will lift its free float from 23% to 30%, by rolling out a $688 million reinvestment plan involving minority shareholders – details to follow.

- For example, at a 5% discount to the existing share price, the company would need to issue ~186 million new shares.

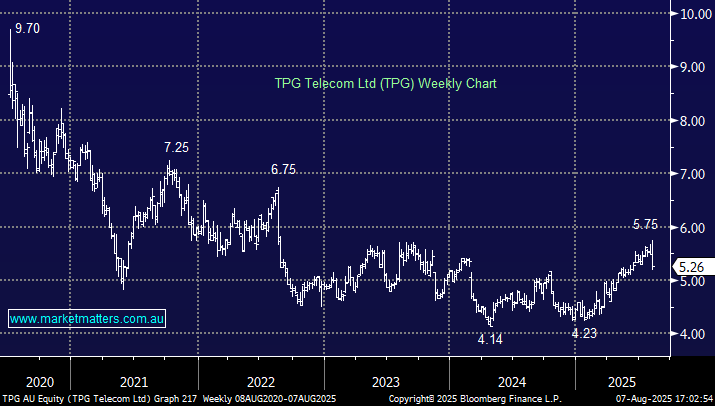

We see downside risks if shareholders don’t fully buy into the Australian mobile-network operator’s reinvestment plan – the market agreed, dropping the stock following the news. The company also disclosed a new policy of increasing dividends over time as profit and cash flow grow. The FY25 dividend is targeted at 18c, equal to the FY24 dividend. The bottom line is that the announcement fell short of expectations, drawing the stock back towards the $5 area. TPG will now depend more heavily on its mobile business to make money moving forward, and how well it grows this area will determine the share price.

- We no longer see TPG outperforming into 2026 and are removing TPG from our Hitlist.