Telstra hit a 6-year high on the 21st of June at $4.46 and has since pulled back 58c/13% to trade at $3.88 yesterday. While they traded ex-dividend for 8.5c fully franked during the period, the share price has clearly underperformed, prompting the question of why, and what should we be doing, if anything.

Their FY23 results were solid, particularly in Mobile which makes up ~60% of their earnings. They confirmed the turnaround towards growth is ongoing, with earnings up 9.6% on the same time last year and the highest for a decade. This is underpinning growth in dividends, which at 17cps for the FY was up from 16.5c in FY22 and the first lift in 6 years, with another increase expected in FY24 which should see it on a yield of 4.64%. Growing earnings, a growing dividend and a large, conservative company, with an irreplaceable asset base – what’s not to like?

We suspect there are 4 main reasons for the recent sell-off, that will ultimately subside, and TLS can re-capture its mojo:

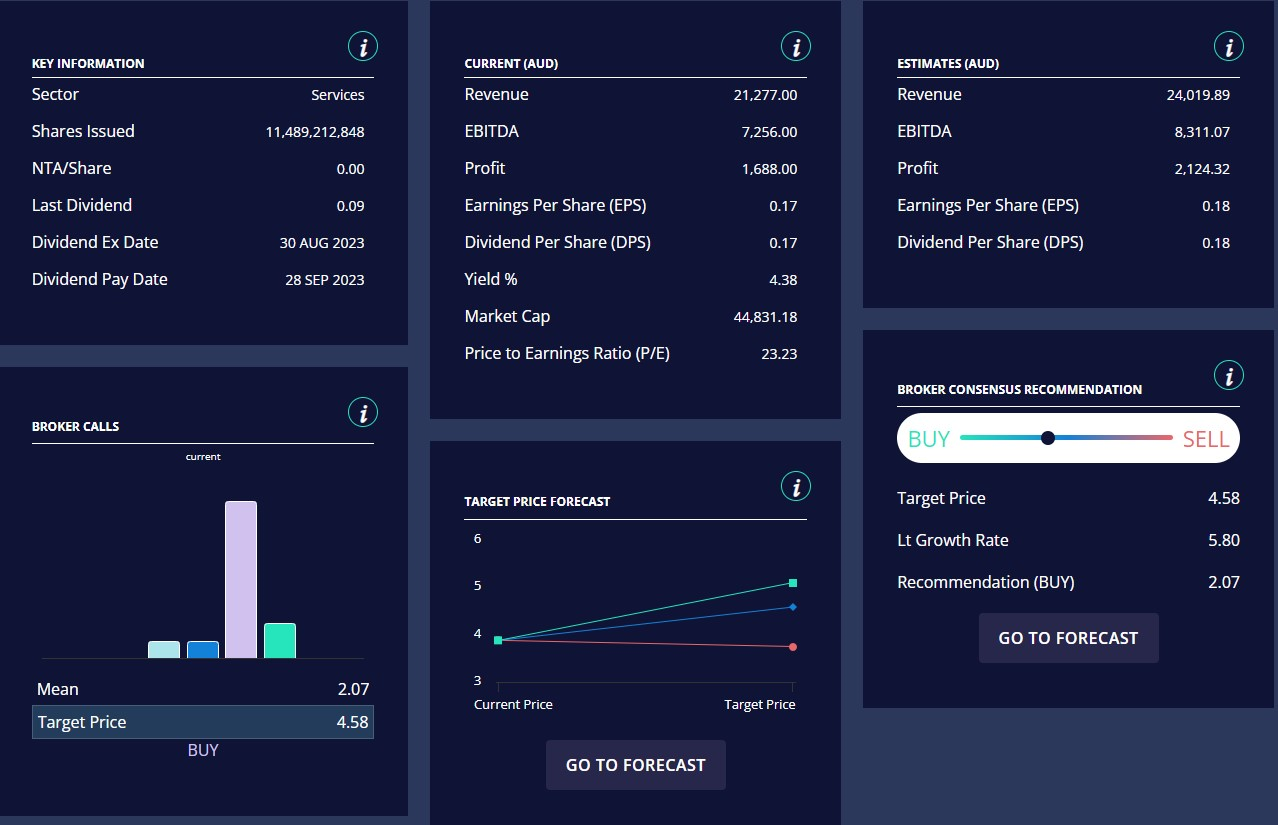

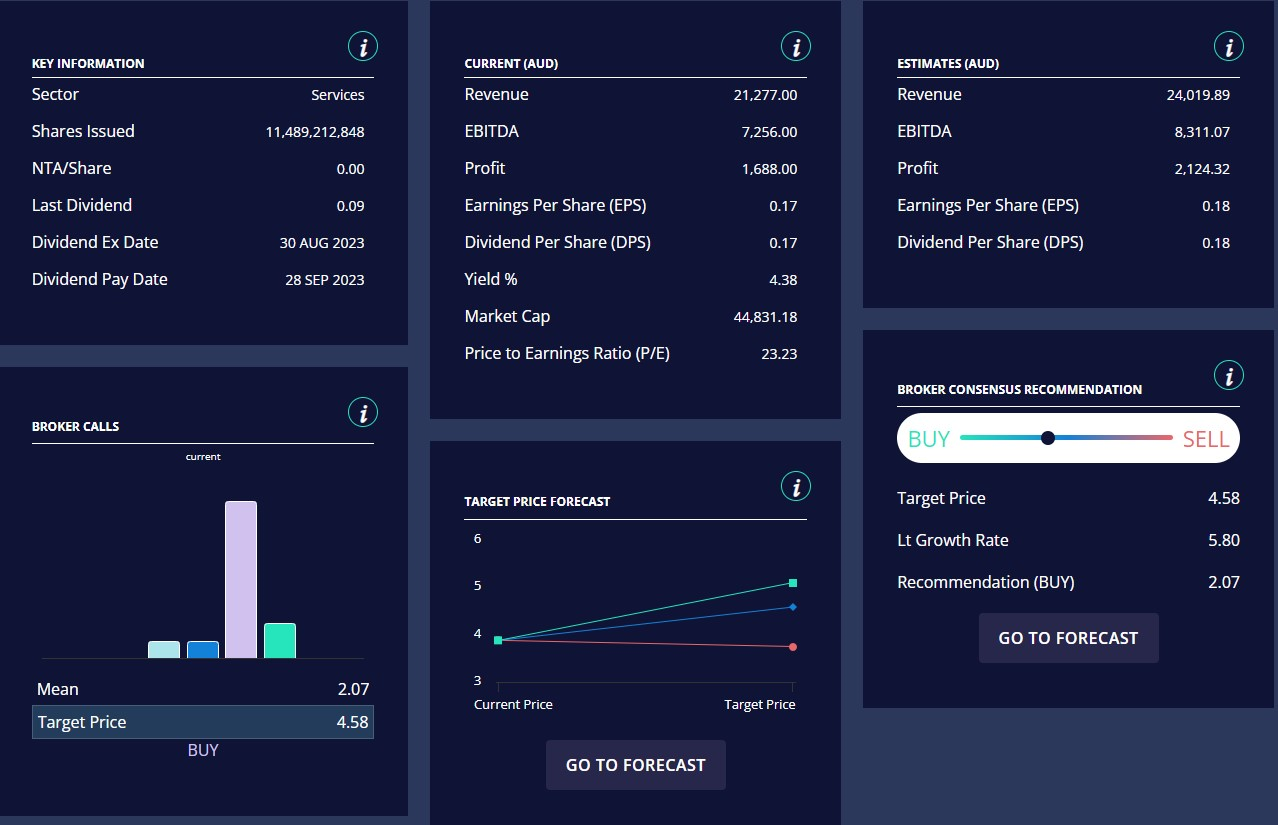

- Market positioning: The market was universally bullish, leaving a dearth of new buyers. Of the 13 analysts that feed into the Market Matters website, there are 11 buys with a consensus price target of $4.58, 18% above the current price. We’ve observed over recent years a complete ‘about turn’ from the analyst community, transitioning from an outright bearish view to a more balanced one, to now, a very universally bullish stance. Positioning is important and it seems to MM that such positioning predicated on the points above, has left an air pocket of new buyers.

2. Infrastructure divestment: At their August results, TLS said it is now likely to keep the current ownership of infrastructure (i.e. no spin out InfraCo) for the medium term. Some in the market would have been disappointed by this, however, we view this as a positive and don’t believe the value of their infrastructure is being truly reflected in the TLS share price.

3. Mobile improvement will be fleeting: Strength in mobile is driving much of the improvement at Telstra. Higher Average Revenue Per User (ARPU) helps margins which underpins earnings. Lower discounting and a more rational market are the reasons, however, bears suggest this will not last, and that it is a lull rather than a trend. TLS recently announced a FY24 postpaid ARPU average increase of +7% across all of its mobile plans which is clearly a positive for this year at least. As companies push price increases through, we find it highly unlikely that these will be cut in the future, in any meaningful way.

4. Finally, valuations relative to history were on the high side, with the TLS P/E now back to more ‘normal’ levels.