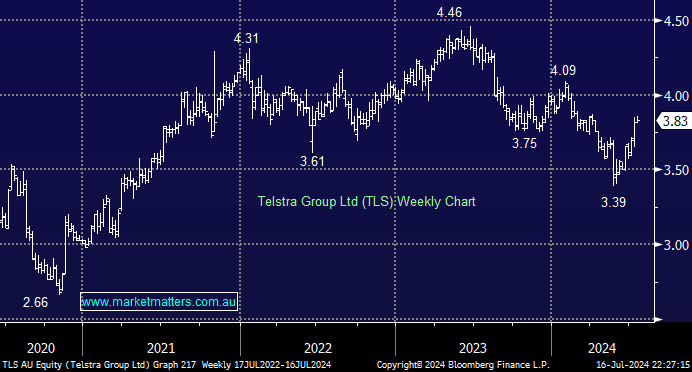

TLS has experienced several broker upgrades in the last few weeks, which have turned around the share price, with the stock now up +13% from its May low of $3.39. In early July, they announced a series of price increases at a rate well above inflation:

- In Postpaid, 1) $50 Starter plan unchanged, 2) $62 plan to $65 (+5%), 3) $72 plan to $75 (+4%).

- On Prepaid 1) $35 plan to $39 (+11%), 3) $45 plan to $49 (+9%), 3) $55 to $59 (+7%).

According to the UBS Evidence Lab, which conducts consumer research, its findings suggest that overall churn intentions across the industry remain stable (and low) despite consumers expecting to continue to pay more for telco products. They also think that higher churn is more likely in the more price-sensitive areas of the market, which is not the typical TLS customer.

While TLS is not a growth stock, consensus does have earnings growth factored in for the next few years, up 5% in FY24, 7% in FY25, and 11% in FY26, which means we should see a higher dividend over time.

- TLS is expected to pay 9cps fully franked in August, putting it on a 4.83% fully franked yield for the coming 12 months.