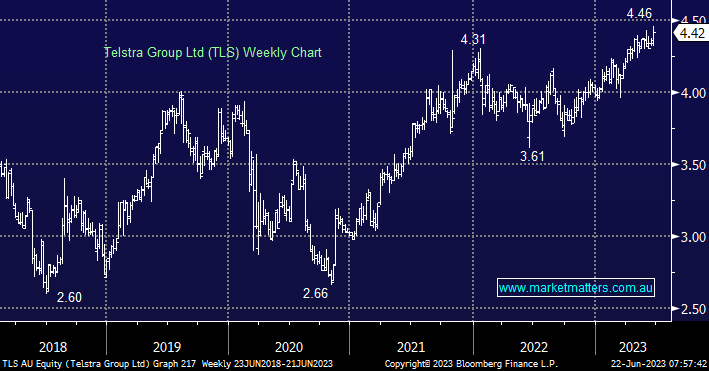

Telstra has rallied steadily throughout 2023 as investors gained confidence in their T25 strategy and began to appreciate the underlying value in their asset base, with the shares up 16% over the past 12 months, while paying out an additional 17c in fully franked dividends equating to over 24c of value, meaning TLS has delivered ~20% in the last year – not bad for a boring, defensive stock!

However, after the share price appreciation, we are now more cautious from a valuation perspective in line with our relatively subdued price growth assumptions beyond FY24 in mobiles i.e. it is yet to be seen whether price growth is likely to stick with consumers longer term without them considering cheaper alternatives.

- We like TLS for income but wouldn’t be cashing the heavyweight telco around $4.40 for growth.