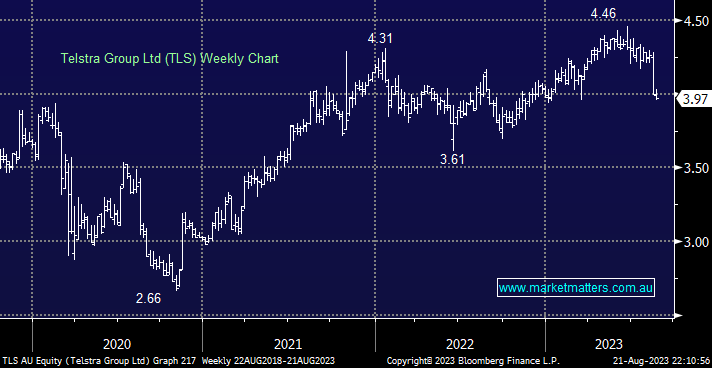

TLS has corrected over -11% from its June high following a negative reaction to their FY23 results last week which saw earnings and the all-important dividend as expected at 17cps (FY) – TLS is forecast to yield 4.4% over the coming 12 months. The important guidance was for FY24 revenue of $22.8-24.8bn (mkt was $23.9bn) & underlying EBITDA of $8.2-8.4bn (mkt was $8.36bn) – again no surprises so we expect many people are wondering why the stocks trading back under $4. The problem was they shelved plans for near-term spinout of infrastructure assets which made sense given the pricing environment has deteriorated.

- We remain positive on Telstra’s outlook over the next two years, with growth in Mobiles, Amplitel, plus scope for further efficiencies beyond FY25e from an operational perspective.

- We like TLS as a defensive yield play over the coming years – MM is long in our Active Income Portfolio