Telstra might be considered a boring stock to many when we consider an active portfolio, but if it can rally ~20% while yielding an estimated 4.7% fully franked over the next 12 months, we believe it is worth consideration, especially if/when we wish to adopt a more defensive stance. Two factors initially jump to mind when we consider TLS into 2024 and beyond:

- Australia’s population is forecast to grow between 1 and 2% per annum over the next 4-years, creating a clear tailwind for the telco.

- The recent Optus debacle should help the company attract market share from one of its main competitors.

They continue to see demand for more mobile data, new products and services from customers, with TLS well-positioned to cement and potentially expand its market share in these areas moving forward. The company is looking to reduce costs while slowly but steadily increasing revenue/profitability, which we believe can see the 18c fully franked dividend grow over the coming years.

TLS held its investor day last week, and we heard nothing to change our confident mid-term outlook for TLS’s growth drivers, which could help underpin the above-mentioned dividend from 18c in FY24 towards 23c by FY26. This increase will largely be driven by growth in its CPI-linked businesses, which constitute 86% of earnings (EBITDA), i.e. Mobile services revenue, InfraCo Fixed and Amplitel. On a side note, their power bill increased by $100m, it’s not just you and I turning off the lights more and more!

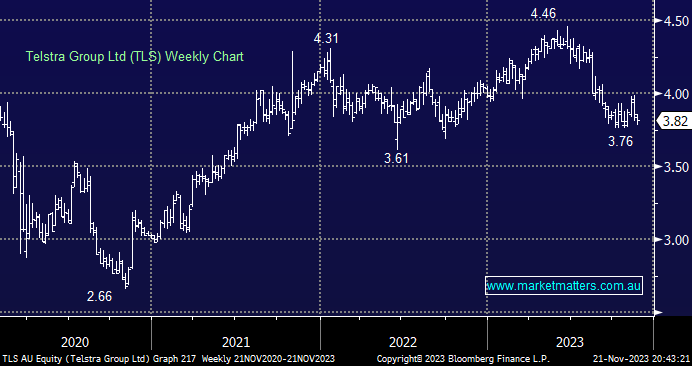

- We like TLS as a reasonable-yielding defensive play, having corrected over -15% from its June high, but fresh lows for 2023 look likely short-term.