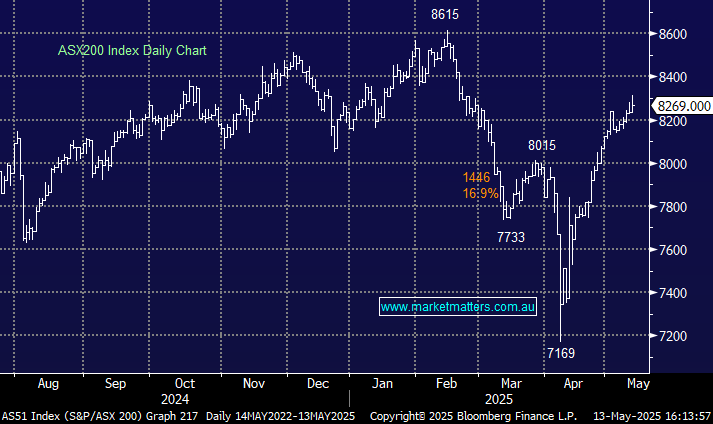

A mixed update from TLS yesterday with a few moving parts; Most of their divisions are performing well, and while the current 18cps dividend looks safe, there are some question marks over growth in earnings and dividends in the next couple of years due to weakness in their enterprise business. This area focuses on providing telecommunications and technology solutions tailored for large organisations and government bodies, and this is struggling, forcing TLS to cut its cost base costing them $200-250m over the next 2 years in one-off restructuring charges.

On a more positive note, their influential mobile service division is going well and it looks like this can grow at mid-single digits compared to the 3.5% the market was expecting. It also seems from commentary yesterday, that strong subscriber growth momentum has continued from 1H24 into the first 4 months of 2H24. One area they did tweak was the removal of inflation-linked annual price hikes from its postpaid plans starting July. This could be seen as a ‘shot across the bow’ to competitors and possibly trigger a price war again, although it seems clear that all providers have been enjoying a more rational pricing environment (at the expense of consumers).

In broadband, the impact of the NBN is also fading, which could give way to margin expansion in that division, while the timing of any sale of their fixed-infrastructure assets is still the wild card in all of this. They reaffirmed FY24 guidance but importantly, issued early FY25 EBITDA guidance of $8.4-8.7bn which is quite wide, and at the midpoint a touch below current consensus, but not by a lot.

Yesterday’s update has seen analysts lower earnings expectations, although some are still optimistic they can grow the dividend from here. At current levels, and based on 18c for the year, TLS yields 5% fully franked or 7.14% gross with some upside potential.

- This is an income stock, not a growth stock, and yesterday’s update confirms as much.