SUL -4.29%: Shares were hit today after the board sacked CEO Anthony Heraghty after admitting his disclosures about a relationship with senior executive Jane Kelly were “not satisfactory.” CFO David Burns steps in as interim CEO.

The dismissal follows ongoing Federal Court cases from ex-executives alleging bullying, victimisation, and non-disclosure, plus an active ASIC probe. The board’s handling—initially defending Heraghty, pursuing aggressive legal tactics, and now reversing course has been poor.

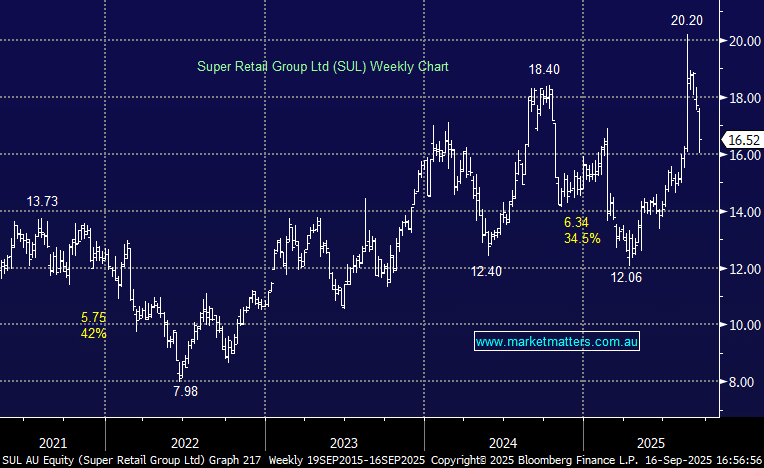

As a consequence, the stock has given back gains made post a good FY25 result and FY26 trading update, that saw the stock scale all-time highs above $20 towards the end of last month.

- We now have a situation of leadership uncertainty, ongoing litigation, and regulatory scrutiny which now overshadow recent retail momentum.

We’re long SUL across two portfolios (Income & Growth) and while we think the boards handling of this situation has been sub-optimal, the recent underlying operational performance implies we should hold on despite the negative headlines.