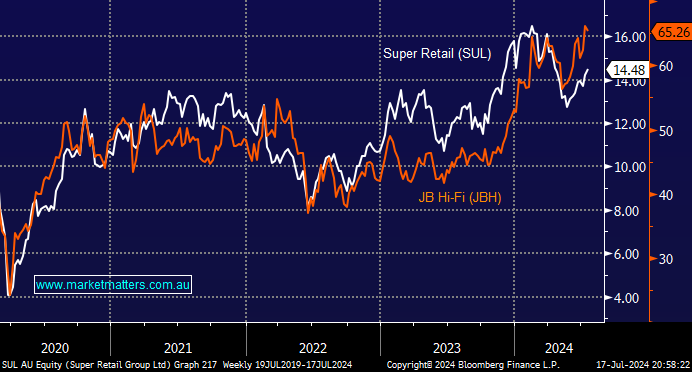

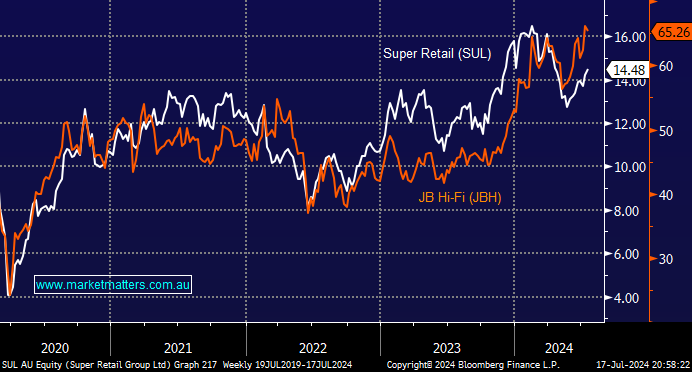

On Wednesday, two of our retail stocks delivered the best and worst performances in the sector: Super Retail Group (SUL) +2.4% and JB Hi-Fi (JBH) -0.5 %. Interestingly, so far in 2024, JBH has advanced to new all-time highs, while SUL has fallen ~15% from its February high. The question that crossed our mind is whether we will likely see further reversion between these two into Christmas.

JBH is trading at all-time highs and is stretched from a valuation perspective based on consensus numbers. However, we’ve flagged previously our view that we believe sell side consensus, in this case, is being too conservative, and it will be this realisation come August that will keep the shares well bid.

SUL is trading well below its February high and screens on the cheap side relative to its more expensive peers. The stock has been weighed down by some internal issue, though earnings have been resilient from their broad cohort of brands. They did imply some margin pressure at their last update, and we don’t expect SUL to beat the streets expectations when they report shortly, but it’s priced accordingly.

Any less hawkish rhetoric from the RBA will be supportive of both stocks.

- We continue to like JBH for growth and SUL for yield. – MM is long JB Hi-Fi (JBH) in our Active Growth Portfolio and SUL in our Active Income Portfolio.

- If we had to pick one right now, it would be SUL due to valuation and the manner in which the market is currently evolving, but it’s a close call between the two.